Global Outlook: Southern Dilemma

Weekly PROPHET NOTES 11/3/25

Welcome to another week. Just as one war has (supposedly) ended, we are seemingly on the brink of another one starting. But while Trump is busy meeting with Xi, he can’t seem to decide what he wants to do with Venezuela.

After a very busy October, the world somehow took a step back with the new US-China deal. However I have an eerie sense of it being the calm before the storm.

Weekly Outlook

US Inc.

After a tense meeting, it appears that the US and China took a step back from their trade war. Recent rare earth restrictions were lifted and the for the April ones the US companies were granted licenses. Additionally the port fees are postponed on both sides, China promised to buy some soybeans and crack down on fentanyl, while the US reduced the China tariff rate from 57% to 47%. The measures are supposed to last a year

Overall, I don’t expect them to hold. It’s a temporary halt as both countries are managing the turbulences associated with a trade war. Once the dust settles, we can expect both sides to resume, especially since China is known (and culturally conditioned) to not accept any deal arrangements at face value.

Trump also instructed the Department of War to immediately start nuclear weapon testing. However, the markets are not taking the urgency at face value and remain convinced that we will not see any nuclear weapon detonation this year:

Pete Hegseth announced another 3 strikes on 4 vessels in the eastern Pacific. It’s the latest escalation in Trump’s war on drugs, and the first one targeting vessels on the Pacific.

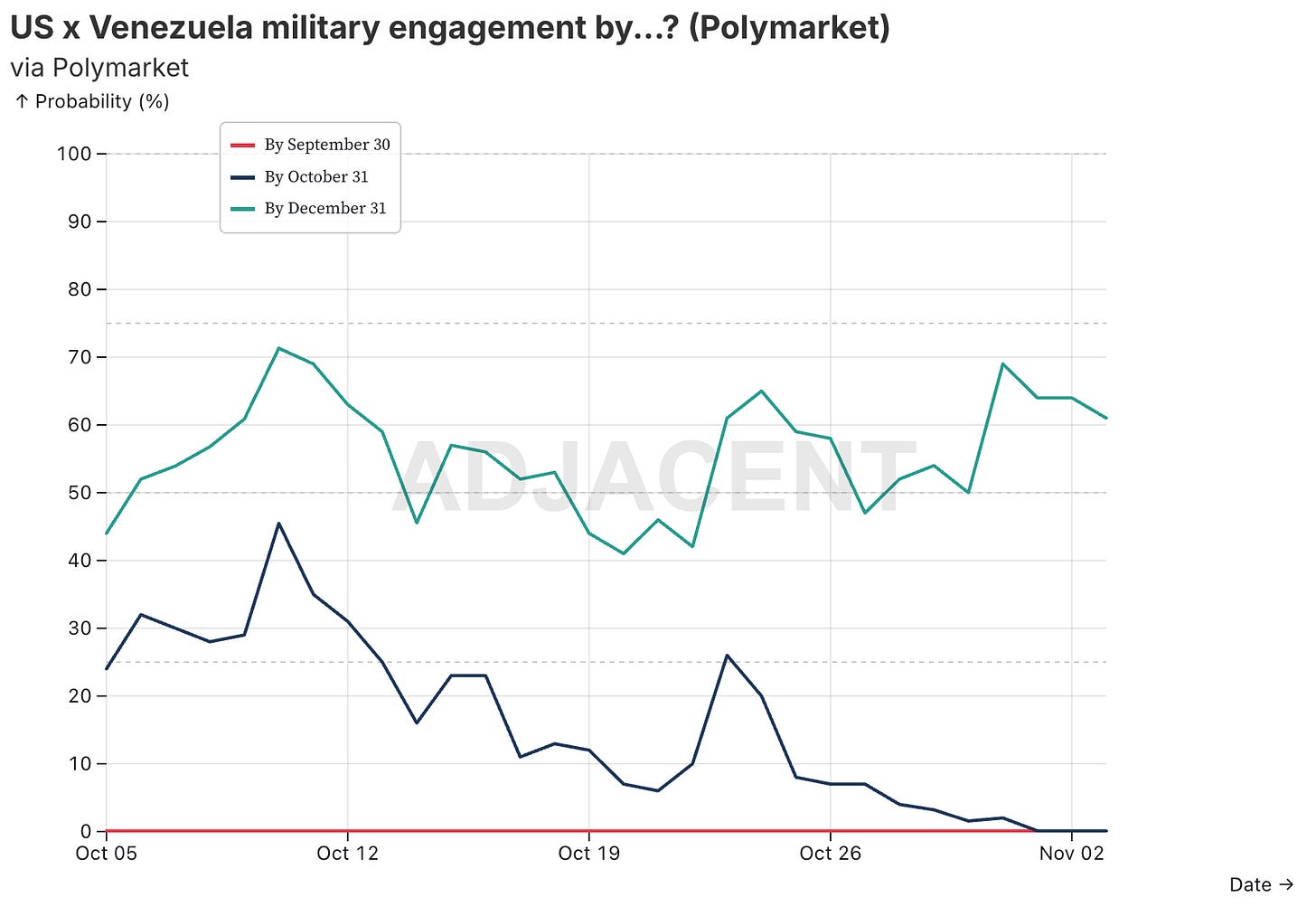

For now though it appears that strikes on boats are the maximum Trump is willing to go. After a piece in the Miami Herald that an attack on Venezuela is imminent, Trump contradicted the statementBe it strategic ambiguity or a conflict in DC, the effect is that traders are split on the possibility of US strike on Venezuela:

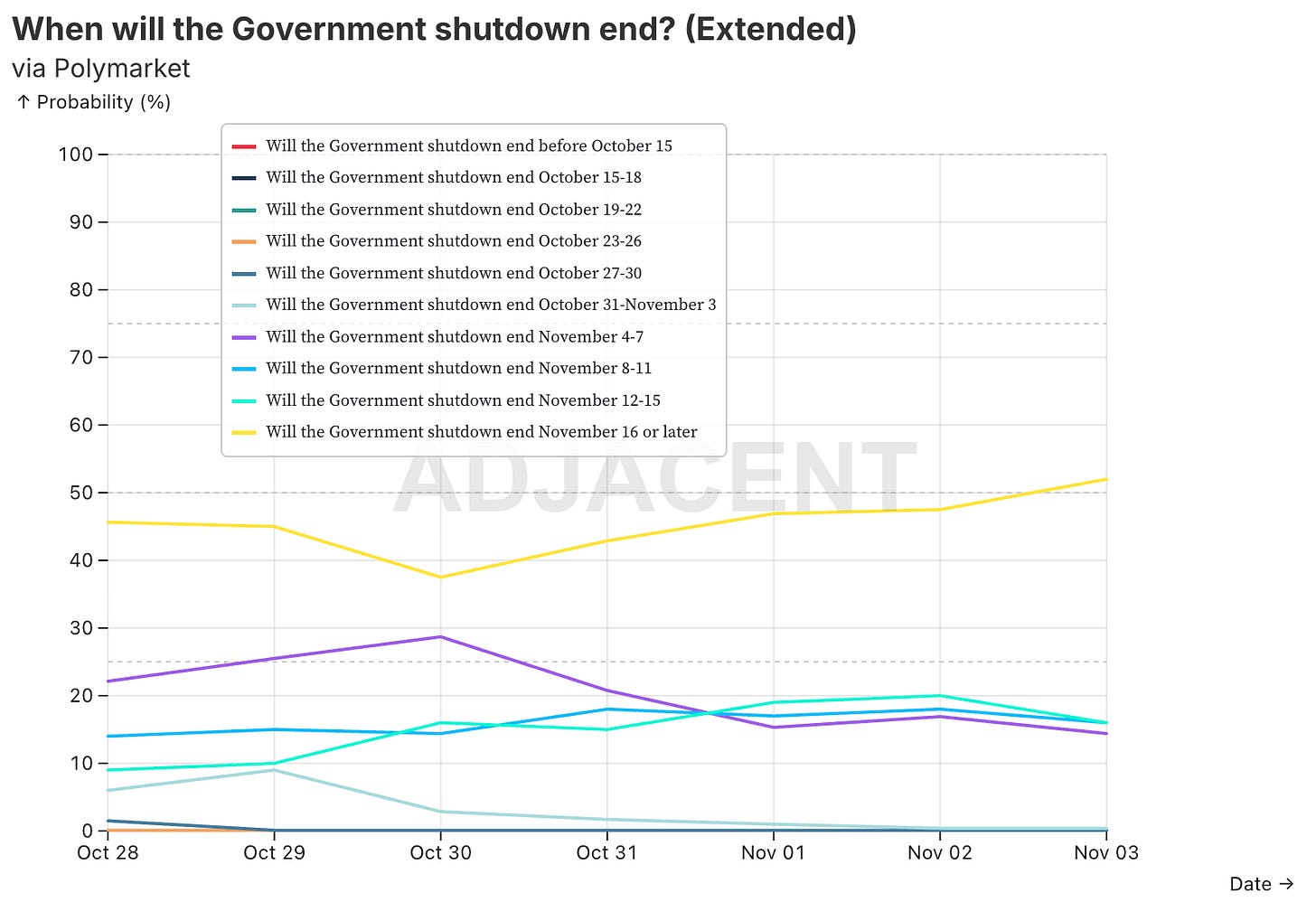

Lastly, the US government shutdown continues into the second month with no end in sight. Starting this week, the SNAP payments are affected, risking millions of Americans will not be able to redeem their food stamps. Traders are looking for 2 more weeks at least before we see the end of the current drama:

The Americas

Besides the drama around Venezuela, we had a police raid in Rio de Janeiro where around 2,500 officers were deployed in the biggest anti-cartel operation to date in the city. There were gunshots in the streets and ultimately 64 people were killed. At least 50 of them were suspected of being criminals - not a reassuring figure if you ask me.

Up north Hurricane Melissa made a landfall in Jamaica and later Cuba. The Category 5 storm brought winds of almost 300 km/h making it one of the strongest hurricanes ever recorded in the Atlantic. It wrecked havoc.

In a (probably) humiliating experience, Mark Carney apologized to Trump for an anti-tariff ad that had offended him. He also asked Doug Ford, Ontario premier, not to run the ad. The trade negotiations however are not back on.

Asia

After the temporary truce with the US, Xi went on a little PR campaign, positioning China as the protector of the global free trade. In the meantime China factory output slumped in October (although it is still positive), but who would believe Chinese economic data anyway?

Middle East & Africa

In the Middle East we were back to the original programing as Netanyahu ordered IDF to carry out strikes on the Gaza Strip. He accused Hamas of violating the ceasefire by handing over the wrong remains of a hostage. In effect Israel launched air attacks on Gaza City, killing at least 100 people, after which Netanyahu decided that the ceasefire can be sustained. It’s nothing more but muscle flexing aimed at establishing dominance.

But this time the real massacre was done in Africa. Rapid Support Forces, paramilitary group in Sudan fighting the government, seized control of El-Fasher, Darfur region main city and proceeded to kill hundreds (or even thousands) of civilians. Scenes from the city were inhumane and the effects were visible even on satellite photos.

Down south, we had another fake African election in Tanzania, where the incumbent Samia Suluhu Hassan was reelected with 98% of the vote after running against no serious opposition. Hundreds are reported to be dead after days of protests while internet blackout and curfew are in place.

Moving west, Trump got interested in Nigeria, which he threatened by suggesting to stop all the aid and even sending troops, unless the government took action to stop islamic terrorists killing christians. The Nigerian spokesman told Reuters that the country would welcome America’s help in combating jihadist terrorism, but only if the superpower respected the country’s “territorial integrity”.

Europe

Russia successfully tested 2 new weapons - a Burevestnik nuclear powered cruise missile and Poseidon, a nuclear powered, underwater drone capable of a speed of 185 km/h and 10,000 km range. Both tests were done mainly to intimidate the west and show to the world that Russia is still at the forefront of military innovation.

Lukoil is looking to sell its international operations following the American sanctions. However, the sanctions are not expected to limit Russia’s ability to sell oil.

After being denied F-35 plane and advanced parts, Turkey signed a deal with Britain to buy 20 Eurofighter Typhoon jets. While a tad below state of the art capability, it’s a move upwards in terms of technological advancement for the Turkish air force.

France continues to be embroiled in a budget crisis after its lower house voted down a wealth tax on the ultra-rich. Part of the Socialist’s demands to approve the budget, the situation is once again fragile for Sébastien Lecornu.

Lastly, Prince Andrew lost his prince title after the publication of a posthumous book by Virginia Giuffre. Andrew was long accused of sexual abuse, but now the situation is completely in the open and the crown had probably no choice. He is also expected to lose his military title of Vice Admiral. While he will be removed from the public eye, expect the royal family to take care of him.

Business, Finance & Economics

Powell once again lowered interest rates by 25 bps to between 3.75% and 4%. However he suggested that the next cut is not guaranteed. In my opinion a lot will depend on the government shutdown ending before the next FOMC meeting. In the meantime the ECB left the rates steady at 2%.

Amazon was initially rumored to reduce it’s white-collar workforce by up to 30,000 (around 10%) according to Reuters. Later Beth Galetti issued a statement claiming 14,000 jobs will be cut due to efficiency gains from using AI (however they have a really cute explanation to avoid saying that). Fake jobs are disappearing.

Qualcomm unveiled 2 new AI chips in a move to enter the lucrative market. They are set to launch in 2026 and 2027 - Qualcomm shares have risen by 12% since the news.

Lastly, OpenAI reached a deal with Microsoft to change its ownership structure. The move opens up the possibility to become a for-profit entity and do an IPO further down the line.

Wrap up

And that is all for the week. In the next 2-3 days I will publish my thesis on Venezuela.

Stay strong and see you soon!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.