Global Outlook: The Art of The Deal

Weekly PROPHET NOTES 5/12/25

There is no rest in the world of geopolitics. This term Trump seems to actually work, whether for the good or for the bad of us all. I was quietly hoping for a calm week, but instead we got a week packed with global events.

From India-Pakistan, through Gaza and Ukraine to new tariff announcements. And that’s on top of three elections happening this week in Europe. Busy times indeed.

Only the beautiful views of Madeira give me now the much needed calmness. Amazing that from Lisbon you can go there for a mere $20. My first impression is great, will touch some grass here and let you know if it’s really worth it.

In the meantime, let’s see the world.

Weekly Outlook

As I mentioned, the week was wild all around the globe. All the bullish announcements of announcements temporarily impacted my P&L, but the roller coaster is far from over.

US Inc.

First surprising news of the week was an alleged ceasefire between US Inc. and the Houthis. A deal was supposedly agreed that they will no longer target shipping. I assume that also the US threatened to support the opposing side and reignite the civil war. Well, there goes my thesis on the war, in the end it was used as a bargaining chip.

Additionally there is a change of direction in the overall Middle East policy from team Trump. There were reports that the US may be ready to recognize the Palestinian state, but they were rejected. Ultimately something else happened - they did a deal with Hamas to free the last American hostage seemingly for free. While most tie the developments to the Gaza ceasefire, I think both announcements (first indicating a softer stance on the Palestine issue, second is a clear decoupling of direct American interest regarding Hamas), hint at being more related to the Iranian nuclear deal.

For now it’s just a working theory of mine, especially since I don’t see how a gesture of goodwill from Hamas might lead them to accept the Witkoff plan.

In the other interesting development, US Inc. no longer demands that Saudis should make peace with Israel as a precondition to advance civil nuclear program. Another development connected with the Iranian deal. I can’t know what the details of the negotiations are (unless they are revealed to me in a dream), but it seems like an act of balancing regional powers.

Lastly on the domestic front, Trump announced an executive order aimed at reducing prescription drug prices by 30-80%. In his words, the rest of the world will pay for it, but no one seems to know how.

The Americas

Quiet period here.

Asia

After a somewhat disturbing period of escalation between India and Pakistan, preceded by the terrorist attack, the ceasefire is in. Supposedly brokered by US Inc. (denied by India), it is now shaky, but still holding.

My initial thesis, as described on X, was that we won’t see an all out war between the two nuclear powers and it seems to check out nicely. It was more about saving face domestically than real war.

Also as a note, the South Korea presidential election is coming, may dabble in it once I come back from my vacation.

Middle East & Africa

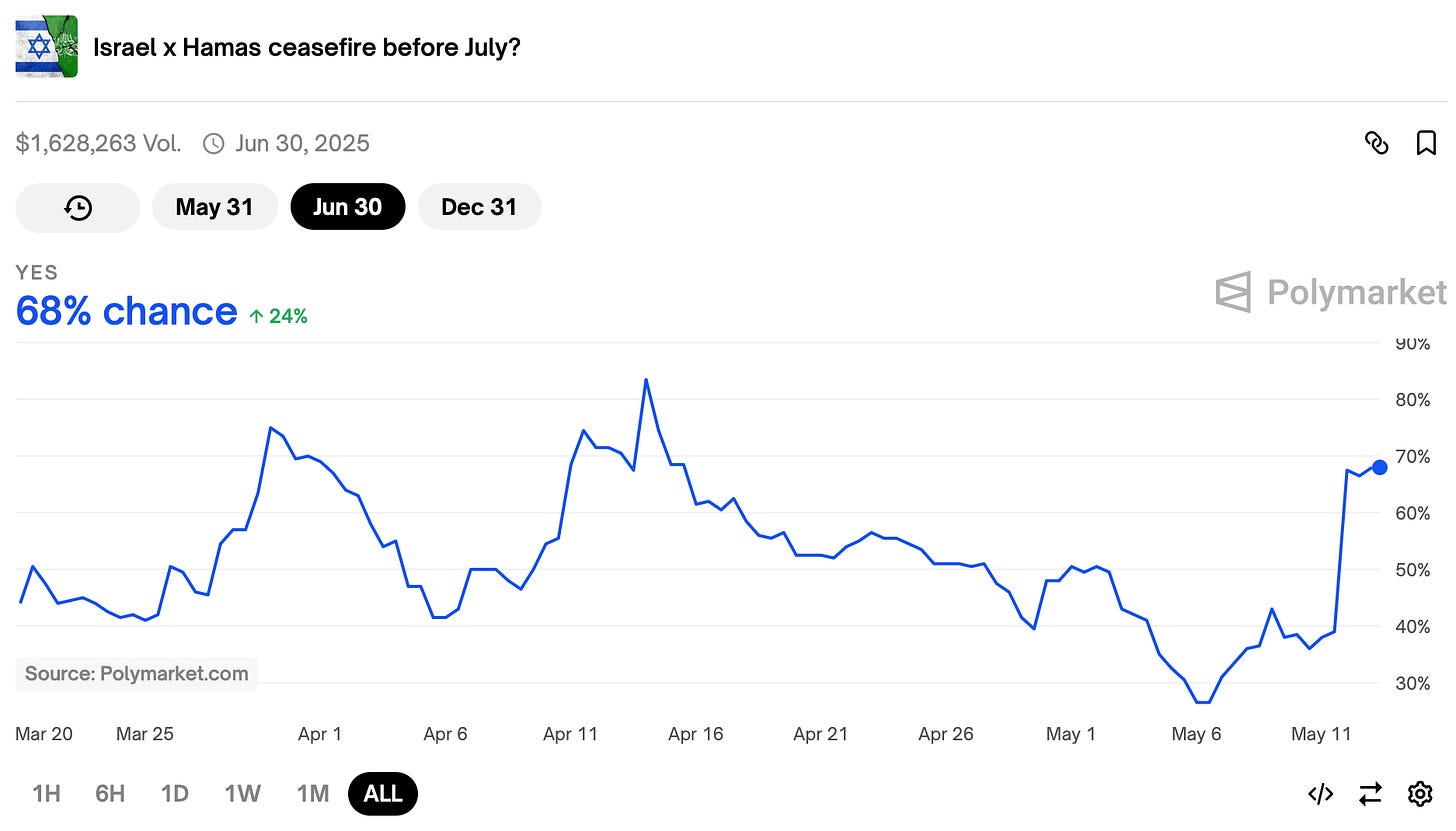

So, the Middle East. After the freeing of the American hostage, there is renewed hope for a ceasefire:

I hold No here for a long time now and as I described in the US section, nothing really shows me that this time is any different than previous spikes. Goodwill from Hamas was IMO aimed at the US-Iran negotiations rather than ceasefire talks as all it did for the ceasefire is that Israel promised to send its delegation to Doha on Tuesday. Yet the Witkoff plan is still the only plan they are willing to accept and Hamas is obviously against it.

Any phased approach, massive amounts of aid or lack of disarming will be met with a harsh No from Israel. Thus I’m still bearish on the ceasefire, less so than a week ago, but still more than the current odds indicate. Only because now there is more pressure on Israel to focus on hostages as Trump just showed that it is possible to get them back.

Oh and the weirdest part about the whole situation is Qatar gifting Trump a plane. Supposedly it’s a gesture of friendship as Trump was complaining about Boeing manufacturing delays, but it all seems a bit absurd. Especially since the plane, after being used as Air Force 1, will then be transferred to Trump Library after the term is finished. Fun stuff… kind of similar to Syria proposing a Trump Tower in Damascus.

Moving to serious stuff, despite the Houthi-US ceasefire, Israel continues to strike them after they struck near Ben Gurion airport. In the last week both Hodeidah Port and Sana’a International Airport were struck in Yemen. Maybe (sic!) the ships are safe, but Houthis didn’t promise to stop striking Israel.

Europe

I covered India-Pakistan, I covered the Middle East, now time for the Ukraine war. So, last week Macron, Merz, Stramer and Tusk visited Kiev for a nice photo-op and a call with Trump, after which they issued an ultimatum for Putin - 30-day ceasefire by Monday or more sanctions.

Well, Putin (maybe after scheming a bit with Xi during Victory parade lol) had an answer for this - direct talks in Turkey on Thursday. Trump endorsed the idea and Zelensky followed through. He will be waiting for Putin there.

Of course ceasefire odds jumped on the news:

However, the enthusiasm is a bit more tempered - as you see each spike in odds is weaker as more and more traders realize the truth - Ukrainian and Russian respective positions are too far apart and neither is willing to go the extra mile to get the compromise.

I still hold No here, on end of June and end of year markets, with No odds still well above my entry price. Usually I’d expect Putin to play ceasefire games, but there is little he can gain from an unconditional ceasefire - to play games you need to have something to play for.

Lastly on Ukraine, a bit outside the usual spectrum of events, two Hungarian spies were arrested in Kiev - they were allegedly planning an incursion. A lot of accusations were thrown at Hungary and Orban and consequently a few Ukrainian diplomats were arrested in Budapest under allegations of spying. I don’t really have an opinion on this though.

Moving to usual politics, in Germany Merz finally became the chancellor in the second round of voting, after he failed to secure the spot in the first round. It is the first time the chancellor failed to secure the spot in the first round of voting since the war, pointing at structural weakness of the CDU / SPD coalition. AfD is surely eyeing the next election where all chances are they will be a force to finally reckon with.

Staying on elections topic, we have three of them happening this week on the 18th of May:

Second round of Romania presidential election where George Simon (AUR, right-wing) will face Nicusor Dan (Bucharest mayor, independent). My initial thesis seems strong, but after the first round fiasco in November I’m staying on the sidelines here.

First round of Polish presidential election with my article on it coming tomorrow.

Portugal legislative election; due to my vacation (in Portugal coincidentally) I will try to enjoy actual views here and not dabble in domestic politics.

And lastly on the old continent, we have a new pope. After a surprising turn of events, cardinal Robert Prevost (an American) was elected as the next pope. Congrats to Domer for making a sweet $100,000 by betting on the outliers and shorting favorites - smart play considering general lack of information and a bold one. Shorting favorites was IMO risky, but great play in hindsight.

Business, Finance & Economics

Moving to Finance, the Fed has decided to keep the rates steady at 4.25-4.5%. Powell in his guidance has also said that America now faces higher risks of both inflation and unemployment rising, hinting at a possible stagflation. Combined with new “trade deals” announcements, the odds for a rate cut in June dropped significantly:

In business a one worthy mention - after more than two decades Skype, an online telephone service, shut down. With it my memories of first online video calls will slowly fade. RIP.

Tariffs

This week of tariff drama served us two “deals” - UK and China. The first one is more of an MoU with 10% rate on most UK products and some exceptions on British cars and steel. The UK airline (not specified) will also buy planes for $10 billion from Boeing.

In my opinion this is more of a nothingburger than a proper deal…

The second one is more of a reset - the US will have 30% tariffs on China with some exceptions while China will have 10% tariffs on US with some exceptions. The deal will stand for 90 days, during which countries will negotiate on next steps. Per Bessent, the initial rate on China from Liberation Day will be the ceiling, while 10% will be the floor for any future deal.

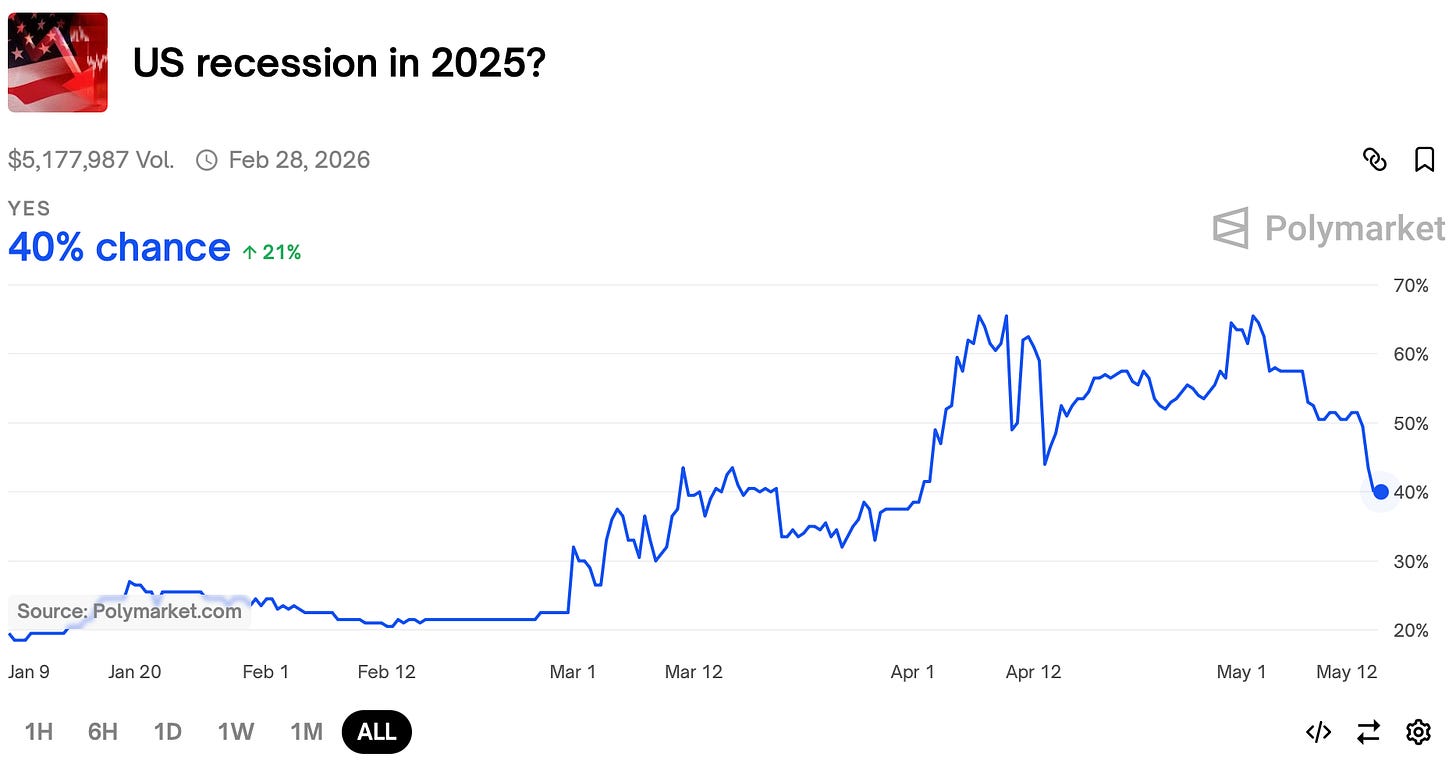

What can I say… obviously the initial Trump plan failed, rates are up, stocks are down / flat since inauguration / Liberation Day. Can’t say I didn’t see it. Now it only remains to be seen if he reversed course fast enough to avoid a recession. Traders seem optimistic, despite Powell’s comments, who surely knew more details before his speech:

Wrap up

That’s all for today. Tomorrow plan is to take a stroll around Funchal, finish the article on Polish election with a nice view of the ocean and give you some alpha on the world.

Stay strong and see you soon!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.