Global Outlook: The China Situation

Weekly PROPHET NOTES 10/13/25

Welcome to another week in this wild, wild world! I wouldn’t call it the best week I had - I lost my high conviction bet on Gaza ceasefire, but on the other hand I found a semi-permanent apartment in my new location.

About my bet, a proper post mortem is coming, and I just may try to do it on video to shake things up! It’s a really curious case and a great opportunity to present deep insight into how global affairs are interconnected.

YouTube or Substack? Or both? You don’t want to miss it so click that subscribe button - it’s not often I lose a bet with such a significance.

Weekly Outlook

Everything, everywhere, all at once. Good movie, even better description of reality. Especially now.

US Inc.

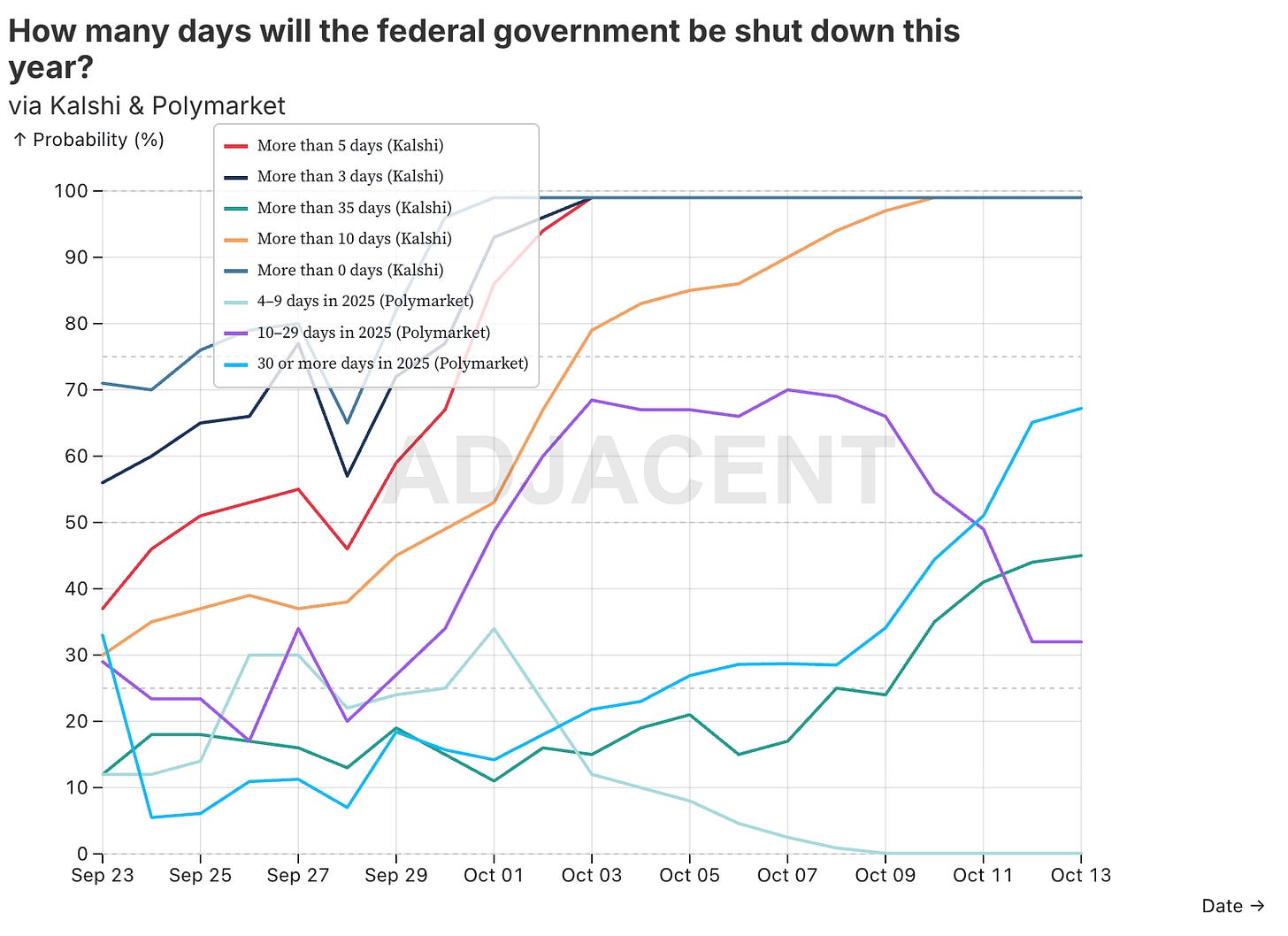

The US government continues its shutdown with projections now reaching over a month. Per Adjacent chart traders are pricing in at least 30 days at almost 70% right now, with over 35 days at 45% and rising. So while we are looking to match or even exceed the previous Trump term record, the administration is starting to permanently lay off workers to put pressure on the democrats. Seems we are in for a ride.

Despite the backlash, for now a federal judge allowed Trump to send the National guard to Illinois. It’s going to be an interesting case as a similar request was rejected in Portland’s case.

The cold civil war is not only limited to provoking the Democrats by deploying troops - as the Biden administration was trying to convict Trump, now it’s time for his revenge as Letitia James was reportedly indicted, following an investigation in mortgage fraud.

Lastly, despite the Gaza ceasefire happening, Trump didn’t win the Nobel peace prize; instead Maria Corina Machado, a vocal critic of Nicholas Maduro, won the prize. Indicative of future actions against Venezuela if you ask me. Additionally, the laureate praised Donald Trump and general reporting suggests that he just might win the 2026 award if the Gaza ceasefire holds. I wouldn’t put much weight to this whole process though, remember that Obama won the prize.

On top of that, the winner was known several hours before announcement, as odds on Polymarket surged to 74% hours ahead of the official confirmation. The Nobel Institute is now investigating itself over the leak, but based on the interview by Fhantom Bets here it seems that there was no direct leak.

The Americas

Moving south, despite Argentina selling soybeans to China instead of the US, Scott Bessent informed that the $20 billion swap line was finalized to prop up the peso and save his buddy investors. Weak statecraft to be honest.

Asia

The news of the week was definitely China announcing stringent export controls on rare earths and other important minerals. As China supplies 70% of rare earths, the restriction caused havoc on the markets. From now on, any entity exporting anything with Chinese rare earths will have to obtain a license, and obviously any military use (or AI use) will not get such license.

It is the opening act of the real trade war, as this is the first time we’ve seen China going on the offensive, using its advantages. The west scrambled to respond - from Trump threatening additional 100% tariff, through the Pentagon purchasing $1 billion in rare earths to the Netherlands taking control over Nexperia, a Chinese chip maker based in Holland. We can expect that ASML won’t get a license from China anytime soon.

I aim to focus more on this escalation once I’m properly settled - it’s been a recurring theme lately, but I signed an apartment lease today so I should be settled fully by the end of the week.

Moving outside of the war zone, Japan’s Liberal Democratic Part is in a bit of a trouble after selecting Takaichi Sanae as its new leader - Komeito, the decades long junior partner of the party decided to leave the ruling coalition. However, traders still see her as the favorite to be the next prime minister:

In Central Asia, Afghanistan is engaging in border fire with Pakistan. A few dozen Pakistani troops were killed along with at least 20 Talibans. Both neighbors have a difficult relationship with each other and it would shock no one if the situation escalated. However, for now it remains fairly stable.

Lastly, we had yet another earthquake in the Philippines where at least 2 people have died. Not a good time to visit the picturesque beaches.

Middle East & Africa

In a bit shocking announcement, a ceasefire in Gaza was reached last week, with all living Israeli hostages promised to be released in return for IDF to withdraw from parts of Gaza and Israel releasing a lot of Palestinian prisoners (2,000 or so).

I am yet to record the post mortem, but I can say this much - Trump had little to do with it and it’s not good. Also it’s probably not over anyway as it’s once again a phased deal. We shall know soon enough.

Anyway, for the very good part of the whole deal, all the living hostages are now back at home and cheers to that! Trump is also taking a victory lap coming to speak in fornt of Knesset and doing all kinds of media engagements.

In the meantime Gazans are trying to return to their homes, or anything that is left of them. Maybe in the coming weeks we will get to know more about the real extent of damage done in the strip.

Europe

Outside of Chinese drama in the Netherlands, there is plenty to cover on the reuglar fronts. Firstly, it seems that Ukraine is bound to receive Tomahawk missiles as the Ukraine war is escalating more and more. On the one side we have Russia poking Europe with drones, on the other we have US admissions about help in targeting Russian energy infrastructure as well as Tomahawk missile promises. We are far from over here. And we will hear more and more about the war in the coming weeks.

In the meantime in France, Sébastien Lecornu managed to be the prime minister twice as after he resigned, Emmanuel Macron reappointed him. Not sure what he can do differently this time, but I have low hopes the budget can be pushed by him. Maybe it’s high time I take more interest in French politics…

Business, Finance & Economics

American stocks can never go down, so just after Friday’s drop, Trump did some bullposting on Truth Social and S&P500 is up 1.5% on the open. Markets can be managed, but supply chains can’t - the China issue is not over and it won’t be for the foreseeable future.

However it was crypto that was hit the most in a sudden $20 billion liquidation after new China tariff announcement. Many traders lost millions, a lot lost their entire portfolio in a single moment. RIP and remember to be cautious when using leverage.

Intercontinental Exchange, the parent company of the NYSE, will invest up to $2 billion in Polymarket, valuing the prediction market platform at almost $9 billion. Big news for us prediction market enthusiasts as Polymarket is entrenching itself in the mainstream, while looking (hopefully) to professionalize itself in the coming months.

Amid the global turmoil gold reached $4,000 per troy ounce, beating yet another ATH.

Lastly in business, AMD agreed to sell chips with overall power consumption of 6 gigawatts to OpenAI, which will receive warrants for up to 10% of AMD’s shares. And so the AI bubble is growing, perpetuated by circular purchases. Can rare earth export ban top it? Maybe.

Tariffs

Lastly, Trump and Carney are talking about US-Canada trade deal. Both leaders are optimistic about reaching an agreement, however we still didn’t hear anything about it.

Wrap up

And that’s all for the week. I need to settle in a bit more before I’m fully back in the game, but it’s going great so far and expect it to happen soon. Some new content will drop this week as well so stay tuned!

Stay strong and see you soon!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.