Global Outlook: The Tomahawk Disappointment

Weekly PROPHET NOTES 10/20/25

Welcome to another week! We started it with an AWS failure that almost caused me to lose all my material for the article, but I learned my lesson a long time ago and always have a saved copy of my work. Anyway, we had quite a busy week as the China-US cold war is intensifying.

I delayed a deep dive about the situation as I’m still figuring out a few loose ends in my thesis, but I should be able to finish it this week. Also a post mortem on Gaza is coming, as it is tied with the overall situation.

That’s it when it comes to announcements, now hit that subscribe button and see the world for yourself!

Weekly Outlook

US Inc.

Just as everyone was expecting that Ukraine will get Tomahawk missiles to counter recent Russian escalations, Trump surprised us with a lengthy call with Putin. Over 2 hours long conversation sparked yet another ceasefire attempt as well as delayed Tomahawk deployment on the frontlines.

When I look at the situation, I see signs of Trump trying to hinder the wider western effort to equip Ukraine, while hiding under ceasefire disguise. While Russia might be now more willing to have a temporary halt of action, considering the damage to its refining facilities, I still don’t see Ukraine and the wider west accepting such a deal. Just when they have a chance to inflict serious damage. However, we shall see more developments around the ceasefire, potentially with market odds surging at some point.

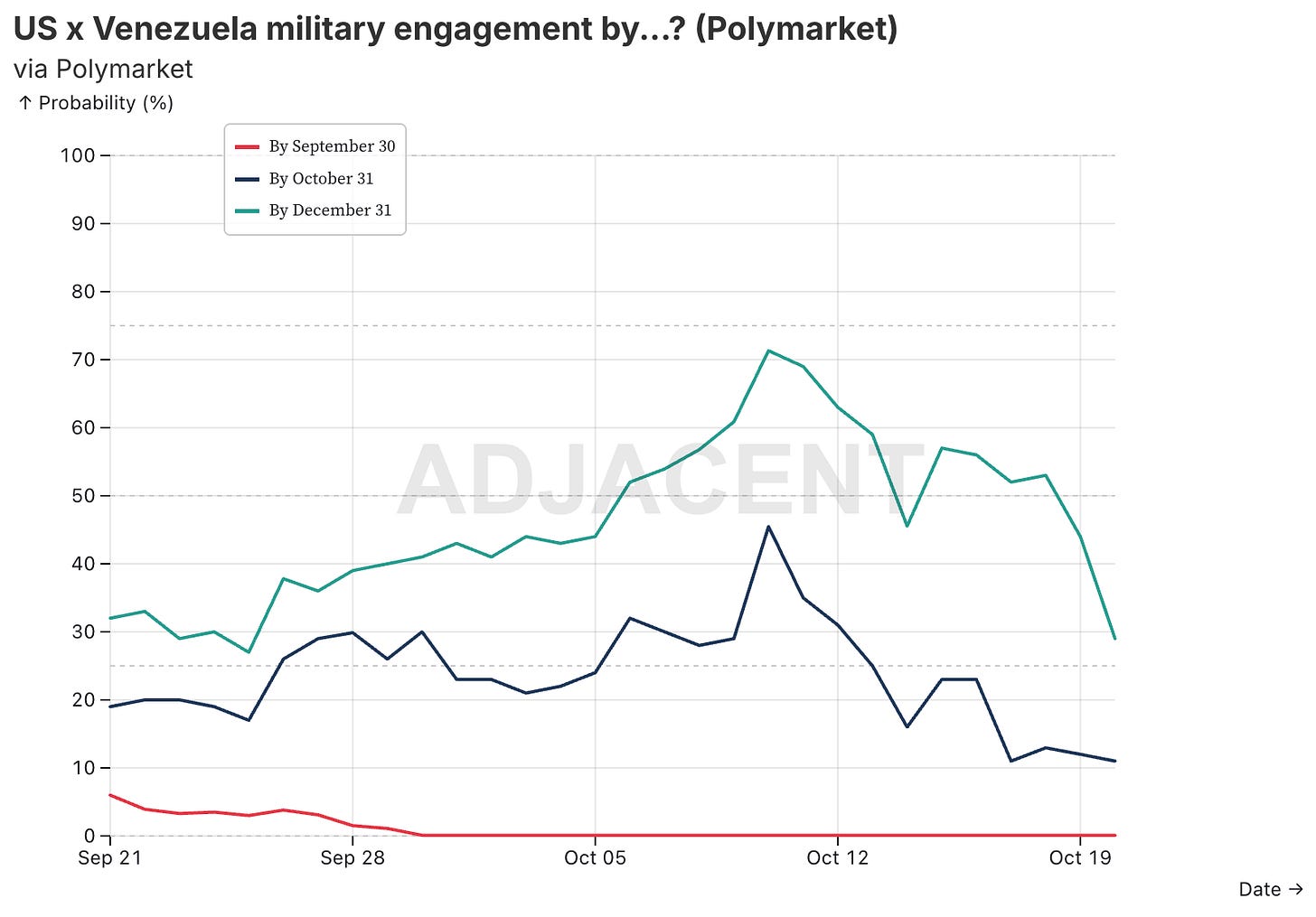

In the meantime, the US is continuing its strikes on Venezuelan drug boats, amounting to 7 since September. I need to dive deeper into the situation as I don’t see a sense in striking random boats. And I heard that the US admin was engaged in complex talks with the Maduro regime, which supposedly offered a lot to prevent an American intervention. Traders, once bullish on the confrontation, are becoming more reserved about its prospects.

On the domestic front, amid another wave of No King protests, the Trump administration is trying to leave a lasting legacy by revoking visas of 6 foreigners who “celebrated” Charlie Kirk’s assassination. Additionally, Charlie was awarded a posthumous Presidential Medal of Freedom. Maybe we will even get a Charlie Kirk Day, who knows. Anyway, the culture war in America continues.

About the culture war, the Justice Department indicted John Bolton, Trump’s former national security adviser, with 18 criminal counts related to transmitting and storing classified information. The current outspoken critic of Trump denies the allegations.

Lastly, a global shipping climate tax will not happen anytime soon as the International Maritime Organization pushed the discussion on the topic back at least a year. It is definitely no time to put additional pressure on international trade.

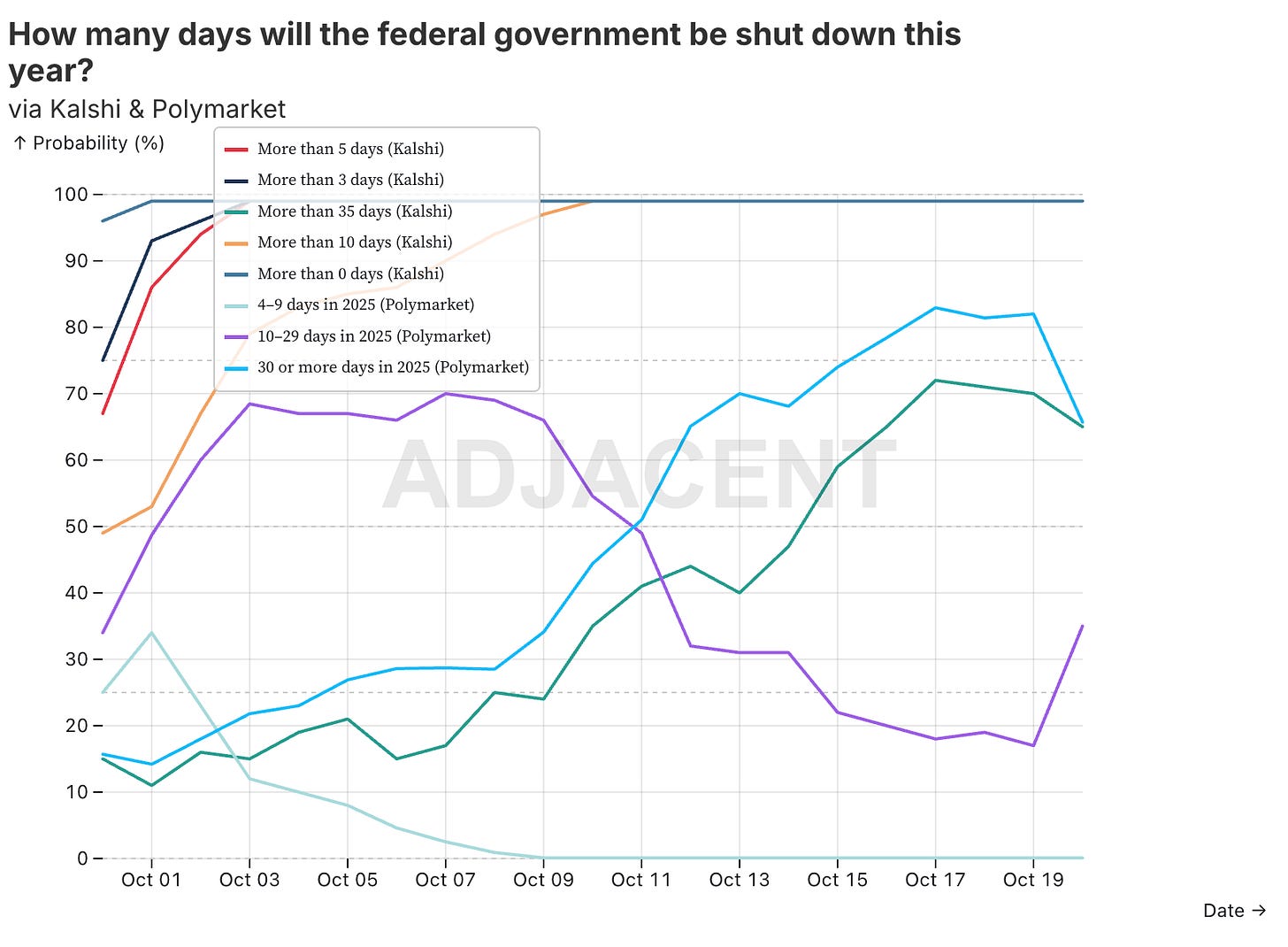

All of this happens while the shutdown continues. Traders are now pricing in a really long one, while I believe that the shutdown itself is part of a wider struggle in Washington.

The Americas

We had a second round presidential election in Bolivia, where Rodrigo Paz secured a victory over Jorge Quiroga, ending a nearly two decade MAS rule. Congrats to Rodrigo and Polymarket traders who correctly pointed out the winner (I didn’t have any shares on the market).

Asia

Chinese economy grew 4.8% y/y in the third quarter - while impressive, it’s the weakest pace in a year. The cold war has effects on both sides. The Communist Party has also gathered for the fourth plenum, where they will discuss a new 5-year plan.

China accused the Philippines of violations and provocations in the South China Sea, after repeated incidents between the two country’s boats. Taiwan was also on the focus as Xi congratulated a newly elected KMT party leader. KMT is advocating for deeper ties with the mainland.

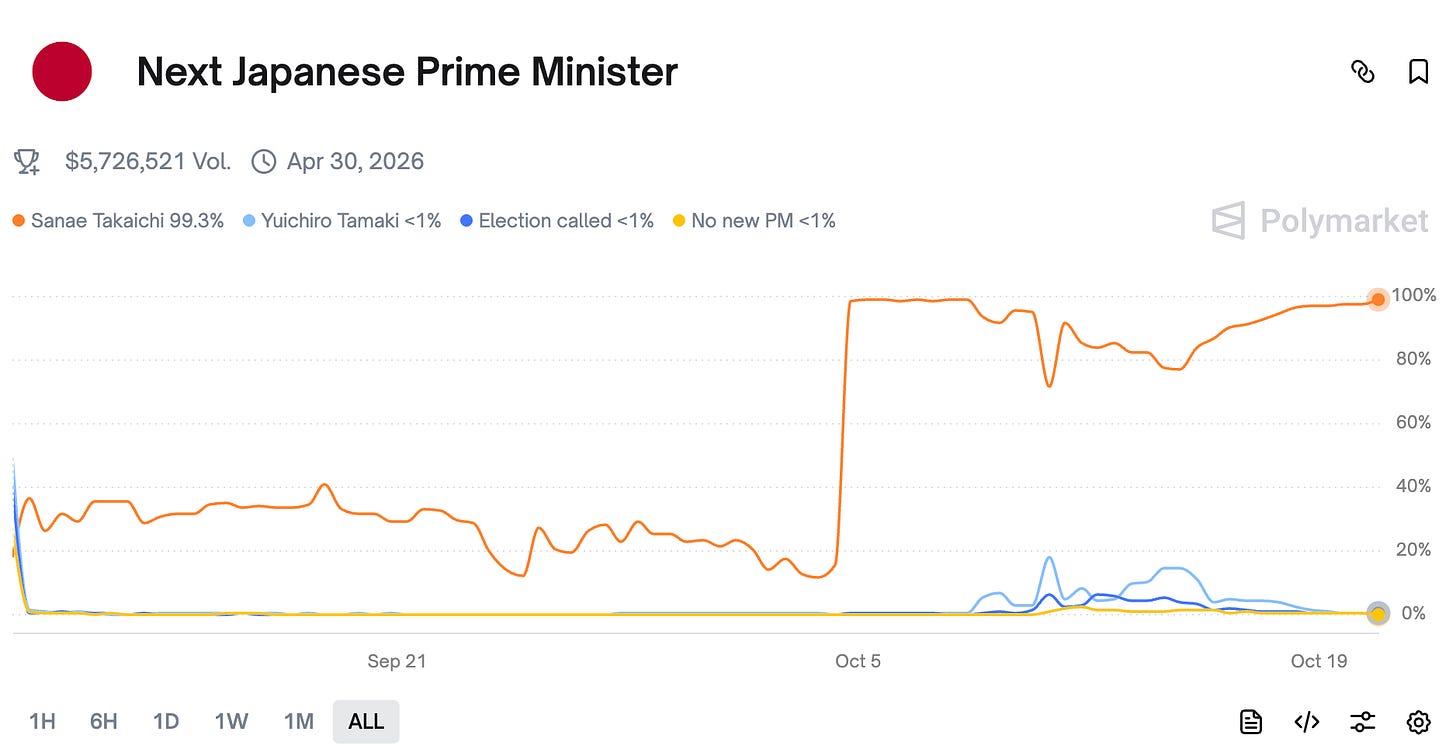

In Japan, Takaichi Sanae is once again looking safe to secure the PM spot. Last week there were some doubts as Komeito, a long standing coalition partner of LDP exited. However, now the center-right Japan Innovation Party will rule along LDP.

After a week of fighting along the border, Afghanistan and Pakistan signed a ceasefire agreement in Qatar. This time Trump had nothing to do with it! Additionally, both sides will meet in Turkey this month to talk further.

Middle East & Africa

Last week, the Middle East saw Trump taking a victory lap and signing irrelevant peace plans, aiming to build on Gaza ceasefire. Irrelevant, because the Gaza ceasefire won’t really hold - sooner or later Israel will continue it’s mission. More on that later in the week in the post mortem.

While the living hostages were returned, the dead hostages are still being delivered by Hamas, and chances are that not all of them will be. Additionally, there are ceasefire tensions. First of all, Hamas is trying to regain control in the strip and was seen executing men accused of collaborating with Israel.

Second of all, there were already strikes, from both sides, on the weekend and the ceasefire was nearly broken. That being said, Israel can’t fully break the ceasefire yet. But there are signs everywhere that it won’t hold.

Leaving the Middle East, Andry Rajoelina, Madagascar’s president, fled the country thanks to French help. Part of the military joined the protests in the country and the president warned of an attempt to seize power from him. He said that there was a plan to assassinate him. And effectively, after he fled the country, the opposition moved to officially remove him from office. However, it still remains to be seen what will come out of the situation.

Europe

Another political crisis continues in France. Lecornu, after resigning from being the PM, was reappointed by Macron in a shocking turn of events. He formed a new cabinet, barely survived a vote of confidence and now is proposing to suspend Macron’s pension reform (that raised retirement age to 64 years) until 2027 on top of announcing a new tax on large firms and wealthy households. He hopes it will be enough to win the support from the left and pass the budget.

Poland ruled that a Ukrainian man accused of blowing up Nord Stream should not be extradited to Germany. As the blowing up of the pipes was overall beneficial to Poland vis a vis Germany, it is no shocker.

In Britain, Prince Andrew renounced his royal titles as the posthumous memoir of Virginia Giuffre, an Epstein victim connected to prince Andrew, is released next week. Looks like things are about to get spicy.

Lastly, Waymo is set to enter London next year with its self driving taxis, making a first for Europe in what will be a tough battle with bureaucracy. Sooner or later autonomous vehicles will be the standard, but Europe is a difficult market for innovations.

Business, Finance & Economics

As we are nearing another FOMC meeting, Powell indicated that the Fed will likely cut rates again, citing continuously rising risks to the labor market.

The price of silver hit a record $52.21 a troy ounce on the fears of dwindling supply.

Additionally, there was a bit of a scare on stock markets as worries over credit risk sparked a sell-off of regional banks in America. However we are back to up only now.

Amid all of this, the IMF lowered its global growth forecast to 3.2% in 2025 and 3.1% next year. Less and less people care about GDP though, as it is proving to be, well, just a number, that often has little correlation with reality.

Moving to business, TSMC net profits rose to $15.1 billion, a 39.1% increase this quarter on AI demand. At the same time the calls that we are in a massive AI bubble continue to be louder.

In a more geopolitical business news, Google will spend $15 billion over 5 years to build it’s largest AI data center in India. American companies investing heavily in India are aiming to secure its alliance to the US, among other, broader moves.

And lastly, LVMH rose 12% on the better than expected earnings. The increase is fueled by rising demand in China. This is not a poor country if anyone still has any doubts. People along the coast have a very high standard of living there.

Tariffs

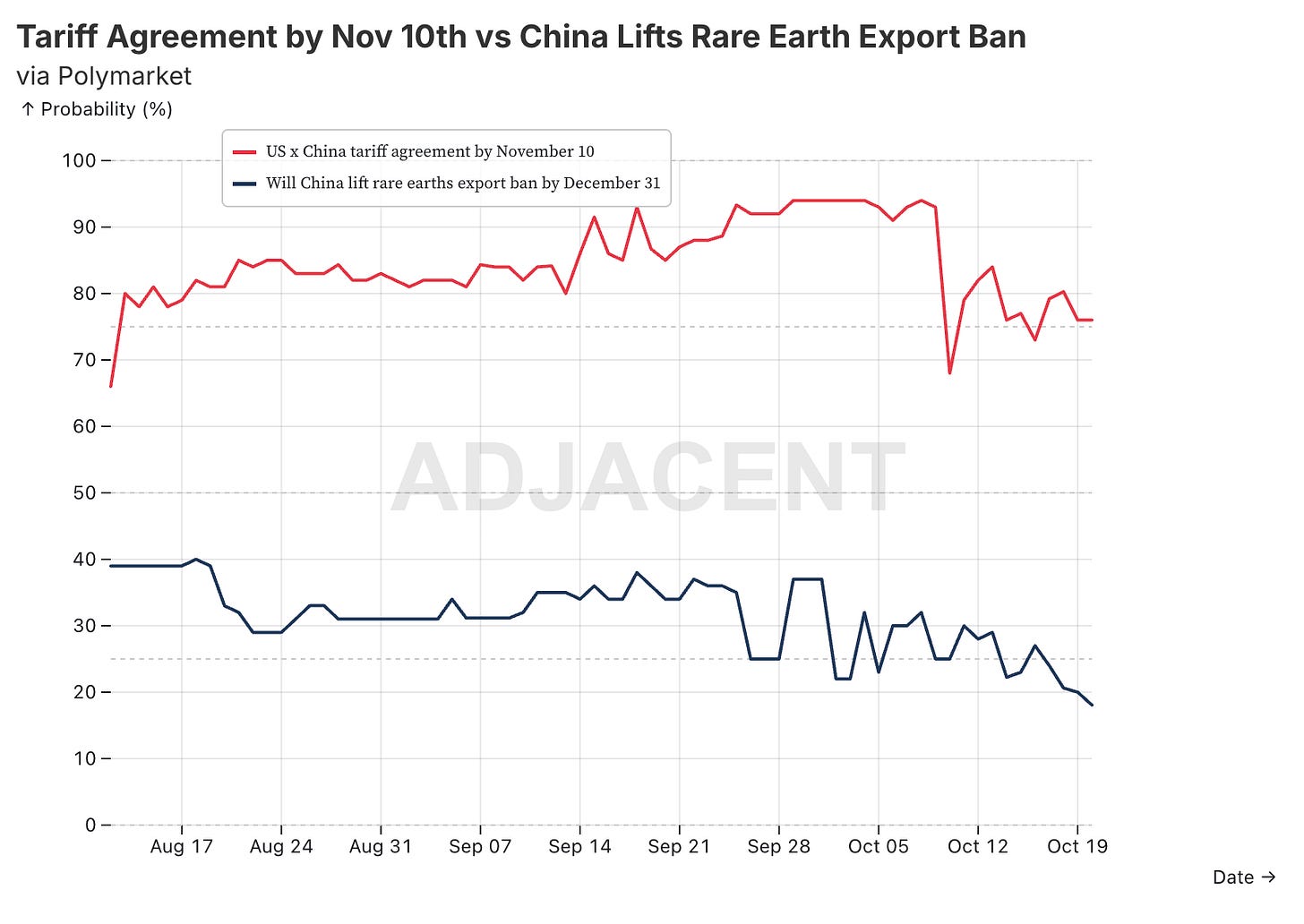

We are hearing voices that we might not see 100% tariffs on China after all, but as always, it remains to be seen. Trades are bullish on some sort of agreement being reached before the deadline (worst case, an agreement to extend the talks ;)):

However, they remain bearish on the rare earth’s export controls being lifted.

Wrap up

It’s been a busy week for me, but I’m now happy to announce that I am fully set in my new place so starting tomorrow I will have way more time to focus on posting, researching and making money on the markets.

Expect a lot of great content and as always, stay strong! Se you soon.

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.