Global Outlook: War and Peace

Weekly PROPHET NOTES 8/11/25

When you are speed-running a presidency like Trump, the cyclical resurfacing of failed projects is inevitable. There is only so much to do in international affairs. And in this magical way, once again the Russia-Ukraine ceasefire is back at the top of the news cycle.

While my deep dive on the second attempt is coming (probably tomorrow, there was a lot of material to cover), do enjoy this outlook. This week’s title is inspired by Leo Tolstoy, but contrary to his novel, it is way more literal.

Hit that subscribe button and see the world as it is.

Weekly Outlook

In a true balancing act, while some wars are ending (or at least trying to), others are escalating.

US Inc.

The big news of the week could only be topped by the bigger blunder. Steve Witkoff met with Putin last week in Moscow. He went there ahead of the secondary tariffs implementation in the last push for a ceasefire.

And I’m not sure if he was just too eager to secure the talks, too scared to ask for a clarification or just plain stupid, but it seems that the touted proposal is even worse than the initial deal.

Initially the announcement sparked huge enthusiasm among Europe, US and even Ukraine. Of course, Europe and Zelensky were pushing to be included in the talks, in vain. However, it soon turned out that what appeared to be a 1:1 land swap before a ceasefire (Ukraine to exit Donetsk and Luhanks for getting whole Kherson and Zaphorozia Oblasts) was in fact a one-sided withdrawal by Ukraine with Phase 2 focusing on some land swaps, with Russia controlling whole Kherson and Zaphorozia.

In the end, Europe is crying that no deal can be reached without them and Ukraine, Zelensky is claiming he won’t cede any territory and Trump is not listening to either of them and will meet Putin in Alaska on the 15th of August. And while the west is divided (and will be even more after European leaders meet today in a meeting convened by Kaja Kallas), Putin discussed the issue with Xi and Modi, with both issuing welcoming statements. More on the topic in the deep dive.

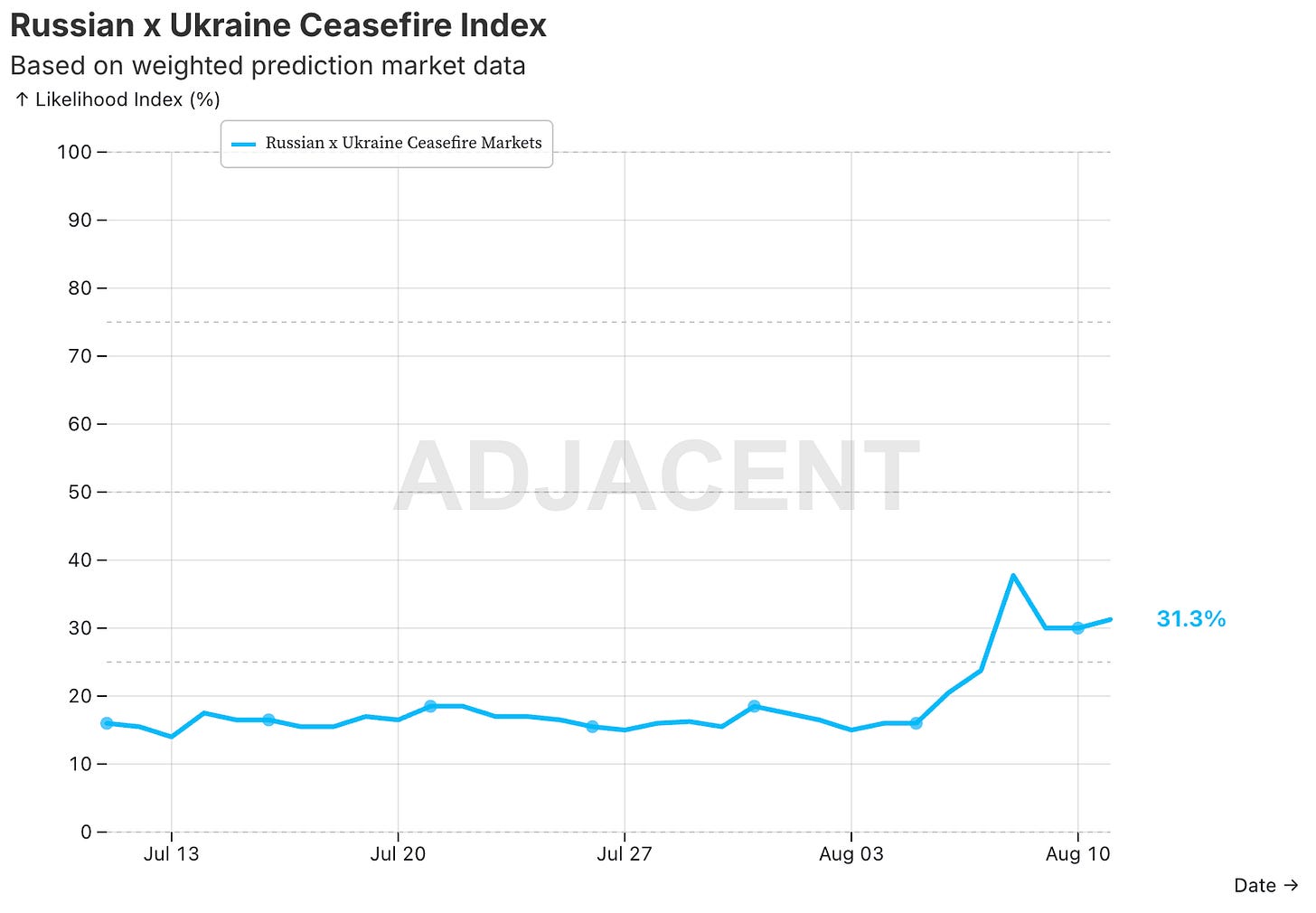

In the meantime ceasefire odds are on the rise, but at 31% weighted it is still quite a long-shot.

Turning to the domestic issues, a sad news from the US Army base in Georgia where a shooter injured 5 soldiers, luckily all are expected to recover. The shooter was an active duty sergeant.

Lastly, Trump accused JP Morgan of debanking right wing customers for political reasons. He also said that the bank refused his deposits after his first term. JP Morgan denied it, but also urged the White House to lower compliance requirements.

The Americas

In Brazil, the Bolsonaro drama continues. The former president who is now accused of plotting a coup was ordered a house arrest after he breached a social media ban. The case is also putting pressure on Brazil-US relations as Trump is accusing the current government of a politically motivated persecution. Trump even imposed 50% tariffs as a penalty.

Asia

Moving to the far east, Australia awarded a $6.5 billion order to Mitsubishi to build new navy frigates. Both countries praised each other amid this move, aimed at strengthening defense capabilities amid rising tensions on the Indo-Pacific. A formal contract is expected to be signed by the end of the year.

In the meantime, Bangladesh is now expected to hold elections in February. Announced by the interim leader - Muhammad Yunus - it will be the first one since a student-led uprising toppled Sheikh Hasina, Bangladesh’s autocratic prime minister, last year. Being honest here, I don’t know much about Bangladesh, but elections in volatile countries are usually interesting so I will take my time and research it more closer to February.

Lastly, once again three Thai soldiers were injured by a landmine on the Thailand and Cambodia border. The army once again accused Cambodia of planting them, and Cambodia once again said they are from the 20th century. This time though there are no subsequent clashes. The country is now focused on the fate of the Prime Minister.

Middle East & Africa

Moving to the Middle East, in a “shocking” statement, Netanyahu announced that Israel intends to launch a full scale military occupation of Gaza. One can wonder, what have they been doing till now? I can say I told you so and the world moves on.

In response several countries moved to recognize Palestine as well as restrict weapon sales to Israel (eg. Germany), however these are more PR movements, than real countermeasures. There is no country forcefully opposing Israel at the moment. And at this point, with most of Gaza already destroyed, I don’t think there will be a single country that will risk waging a war over this small part of land.

I wasn’t sure in which section to include this news, as it is on the verge of Europe and Asia, but so be it. It is far more consequential to the Middle East than Europe. Armenia and Azerbaijan signed a declaration of peace at the White House, marking the end of the long conflict. Trump mediated the deal, and in return the US got a small strip bordering with Iran to develop the “Trump Route for International Peace and Prosperity”.

Iran of course criticized the deal as it puts Americans at their border. Russia was not as harsh, but issued a cool warning to the US, to not repeat the mistakes of the Middle East. Seems like everyone but journalists knows that this piece of land will be used for more than a simple road.

Lastly in Africa, Ghana to be precise, a helicopter crashed and killed 8 people in the process, including Edward Omane Boamah, minister of defense, and Ibrahim Murtala Muhammed, minister of environment, science and technology. They were travelling from Accra in a military helicopter, however the officials are yet to comment on the cause of the accident. Knowing African politics, they were causing some problems…

Europe

Moving to Europe, Norway, through its sovereign wealth fund, is reviewing its investment in Israeli firms because of the public backlash against Israel’s actions in Gaza. This comes after a report that the fund increased its stake in a company that services Israeli warplanes. Additionally, Norway is inching closer to the election - I’m looking forward to analyzing them as well.

In the meantime, Italy approved a $15.7 billion project to build a bridge linking Sicily to the mainland. Italy wants to classify this project as a military one, citing its strategic importance, but I could argue that it is more of an economy one as Sicily has struggled in the recent decades and a new bridge could enable the region to gain more traction with increased ease of movement.

Business, Finance & Economics

Trump nominated Stephen Miran, a big supporter of tariffs, to temporarily fill a vacancy on the Fed’s board of governors. Pending Senate confirmation, he will be there till the end of January (the resigning governor original term). With him on board, we are looking at at least 3 governors being for lowering rates, however the opposition is still strong and economic data points at persistent inflation due to tariffs.

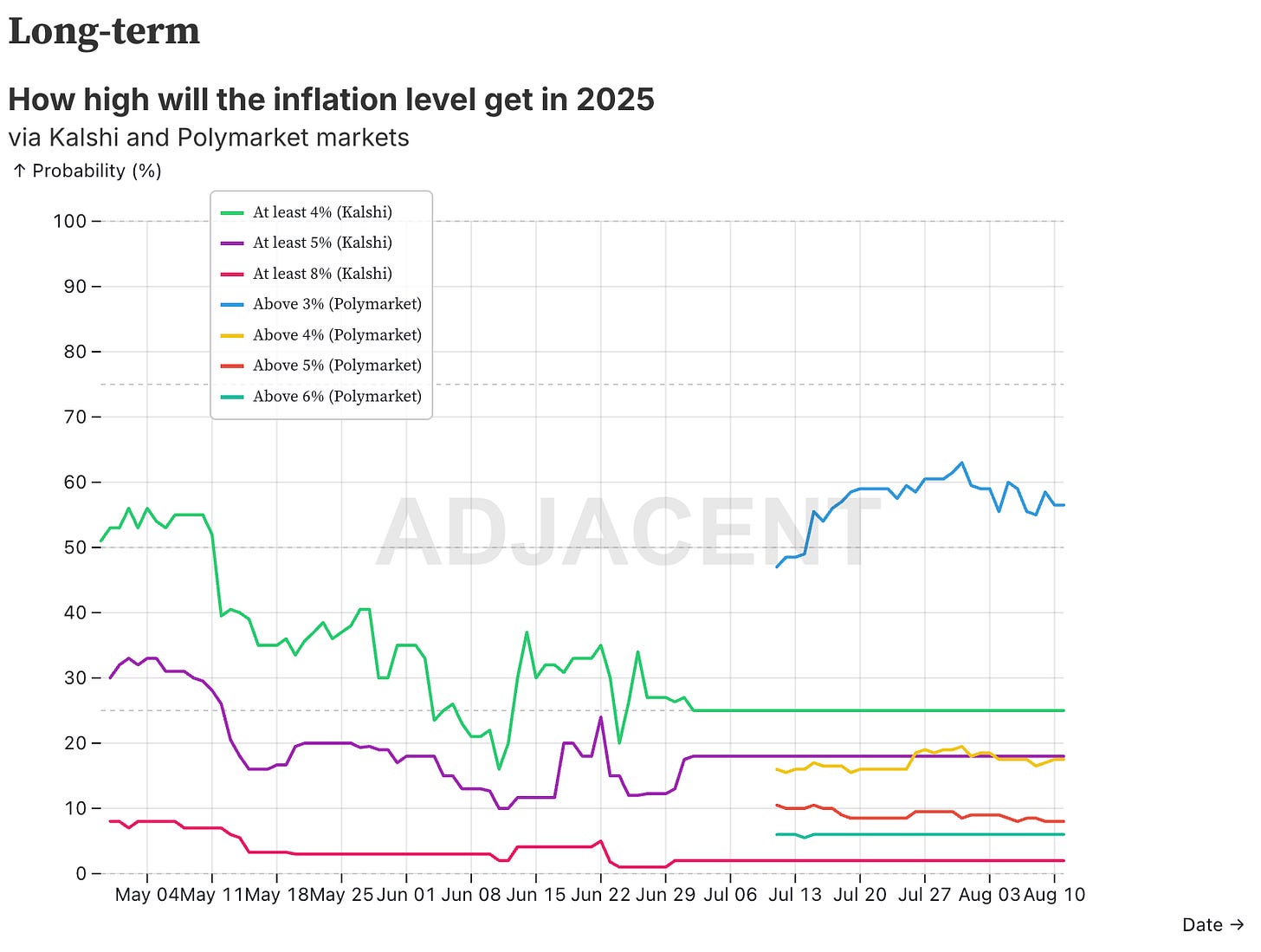

Kalshi data refuses to properly work, but based on Polymarket, expectations are for over 3% inflation by the end of the year.

In the meantime the Bank of England cut interest rates by 0.25% to 4%, despite the inflation spike in June. However, the monetary policy committee said it expect the inflation to peak at 4% in September before moving closer to target rate of 2%, citing lower trade uncertainty as main reason to cut.

Moving to business, OpenAI released two models this week - OOS, an open sourced model as well as GPT-5, its next flagship model. Based on user feedback both missed expectations, especially GPT-5. Users say some progress is there, however there is no massive improvement and GPT-5 is on par with other flagship models from Anthropic (Claude 4.0 / 4.1, Gemini 2.5 and Grok 4).

In my 10 predictions for 2025 I included a slowdown in LLM progress based on limits of the current training approach and lack of more high-quality data. Based on some articles I read this was spot on, with reasoning being the last major improvement in the models.

Tariffs

We have new economic data around tariffs. In the US the trade deficit fell by 16% y/y in June to $60.2 billion, lowest in nearly 2 years. At the same time the average tariff rate rose to 18%, which is the highest since 1934. Trump will call it a success, but at the same time an analysis from Goldman Sachs shows that majority of the tariff costs were eaten by the importers, with ca. 20% being passed to final consumer. However, this is mostly because companies expected the tariffs to be lowered in the near future. If that’s not the case we can expect more inflationary pressure.

In the meantime the tariff drama continues, India now faces 50% tariffs thanks to secondary tariffs on countries buying Russian oil. Modi called them unreasonable and unjust, citing that Europe buys Russian energy exports as well. To be honest he is right, but it won’t change anything. And the situation is not great, because the US should rather draw India closer to them vs pushing it away to the Chinese hands…

If it weren’t enough, Trump also threatened to impose a 100% tariff on semiconductors, with a carveout for companies that invested in the US. This comes as Tim Cook promised that Apple would invest another $100 billion in the US in the coming years. With Apple heavily exposed to trade disruptions it makes sense. At the same time, majority of this amount doesn’t need to actually happen, it’s just a promise after all.

Lastly, in a surprising move, the US introduced a tariff on one-kilo gold bars. Gold futures soared, while Switzerland trembled. Already hit with 39% tariff on watches, its main export product, now the tariffs target another major export product for the country. I wonder what did Switzerland do to the US.

Wrap up

And that’s all for today. Coming probably tomorrow is a fresh look on Russia-Ukraine ceasefire as well as my takes on Bolivia election later on.

There is not that much to be said about Bolivia so I will probably limit myself to an X thread. For now stay strong and see you soon!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.