Weekly PROPHET NOTES 10/14/24

Global Outlook: Trump is back on the top, Google split and more war markets

The fall is here and as the leaves keep falling of the trees, I have also done a bit of shaking and got rid of majority of my bot followers. From 711 to 233 the shake-up was dramatic, but needed as all the (not so) nice ladies following my takes were messing up my engagement. Now I am clean and ready to deliver more.

And there is plenty to deliver. While the Israel x Iran situation is shaping up nicely, there are more new markets and we are three weeks from the US elections. If there ever were a good time for an October surprise, it is now. Besides politics, we of course had new war developments, the Bitcoin documentary premiere as well as some news from the financial world, more on that later.

The Q4 is shaping up to be very busy and profitable. I am looking to extract some more value from the elections in the next few weeks, trading mainly in the last week with focus on smaller markets vs election winner. After that and a bit of a breather I expect more geopolitics markets as well as some protests and the general unfolding of the political situation in the US. Interesting times ahead of us, subscribe below and do not miss a beat.

Enough of introduction, let’s move towards a short summary of the week and what lies ahead.

Weekly Recap

There is a lot to unpack here so let’s go and see the mix of ended markets and other events that unfolded in the last week.

US Politics

I think that the biggest news of the week is Trump officially taking the lead in the prediction markets over Kamala Harris.

Trump is currently sitting on a (not so) comfortable 9 point lead over Kamala. This is slim, but it reflects a few things that unfolded recently:

Trump is campaigning feverishly, his pace is way faster than Kamala’s.

This is reflected in the swing state polls, where Trump has gained a lot of ground and many swing states are a tie now or show slight Trump advantage.

On top of that Trump is podcasting very often, not being afraid of long sit downs and talking about more personal stuff. He is now also bound to appear on Joe Rogan, a massive news. At the same time Kamala is afraid of long-form interviews and her scarce podcast appearances failed to bring in huge audiences.

While this is great for Trump and not so good for Kamala, 54/45 is still a toss up. 22 days left and we have no clear leader. This is shaping up to be an interesting election night with many on the edge of their seats.

In terms of election trading, the recent swing allowed me to sell my Trump position with a small profit. Now I am completely out of the main election markets, holding now some individual states markets. In the next few weeks I am looking to enter more of them.

From other election news, we had JD Vance on the trail. After locking in the debate win, he scored a big NYT interview. He has come a long way since being called weird and all the couch stories. Looking at it now, he was a solid choice (which cannot be said about Tim Walz) and he is delivering. He is like a rational version of Trump, being able to explain his ideas in a digestible manner.

This week we also had calls for another presidential debate. While it would be nice to have some new debate markets and watch the candidates struggle to secure voters, I doubt there will be one as both campaigns are now more focused on rallies and interviews, trying to appeal to voters in a more direct manner.

Circling to other US stuff, Eric Adams is still in office and the drama around him went out of the news cycle for now as we approach the election and are busy with the geopolitical drama. On top of that, we had another hurricane hit the US, with Milton doing tons of damage in Florida.

I will be back with more US politics later on.

Wars

On the Middle Eastern front, besides continuing fights in the south of Lebanon, we saw more muscle flexing last week. Israel keeps issuing new and new strongly worded statements, that have little to do with reality. That is the way of the new war.

On other fronts we had two new interesting developments. In Ukraine we now have another party to the war - North Korea has send its men to fight along Russians in Ukraine. Interesting development, making this war global in a sense. One could even call it a prelude to the WW3. This is not looking like it will end soon.

North Korea was definitely looking for attention this week as not only did they send their men to fight in Ukraine, but also put part of the military on high alert, following reports of an alleged South Korean drone over North Korea. I jokingly commented that the third, more oriental theatre of war is opening and I hope this will only be a joke.

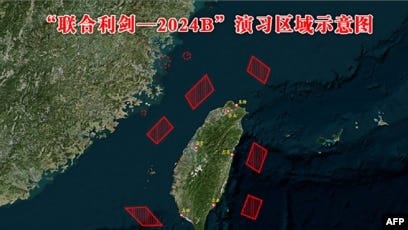

For now at least we can feel at ease. While China started some drills near Taiwan, There were no indications of war logistics being done in China, which excludes a war there in the next few months.

That being said, with 22 days left till US elections, the tensions are high.

Other developments

Besides US politics and wars, there is the whole world to cover. Starting with finance, we had 2.4% y/y CPI print, which should be successful in pushing away 50 bps cut ideas. That did not stop the stock market in search for the new ATHs.

We also saw new developments from Elon Musk: some blunders (we, robot event) which I commented on X as well as some Ws (catching the Super Heavy). Let’s see if his election bet goes the former or the latter way.

Last week we also had a disappointing HBO documentary on Bitcoin that created a lot of fuss over Bitcoin creator, but they named Peter Todd which left the crypto community pretty unimpressed.

Lastly, Kalshi announced last week that they will pay 4.05% APY on both cash and positions. That is a massive development that will allow for better long term markets as well as draw more capital in general towards prediction markets. With this development, along with approval for political markets, Kalshi has caught up with Polymarket and if I were from the US, I would put a nice chunk of my capital there to capitalize on these new developments.

That is all major news from last week, let’s look ahead.

Global Outlook

I am looking ahead and I do not see much. World is holding its breath ahead of US elections and the only thing I could comment on would be the Middle East, which I have already covered and it still applies. One thing to look out for is the October surprise. If any of the campaigns has some dirt on the other side, it is high time to publish it. Some pundits have wet dreams on this, but I do not see a high likelihood of some major surprise.

Donald Trump has been on the political stage since 2015 and all that could have been said of him has already been said dozens of times. With Kamala Harris the situation is similar and I doubt they will find some high-profile case on Tim Walz, enough to move the odds significantly.

Besides wars and the US, we have ECB deciding on rates this week. Eurozone inflation is down significantly:

With rates at 3.5% currently, the market prices in a 25 bps cut this month and another one in December to bring down the rate to 3.0% by EOY. With eurozone economies on the brink of recession, the overall European economy needs a bit of a breathing space and hopes are that lower rates will be enough to prop up the economy. On Polymarket traders have little doubt:

Last, but not least we had new developments on Google antitrust case. The DOJ is looking to break down Google (or should I say Alphabet) into several companies which is huge news. I am looking forward to some markets on this to give you more insight into it on a deep dive.

Markets ending this week

Keep reading with a 7-day free trial

Subscribe to PROPHET NOTES to keep reading this post and get 7 days of free access to the full post archives.