Weekly PROPHET NOTES 3/17/25

Global Outlook: The adjustment period

It feels like everyone and their mother are tired by the recent geopolitical developments. Trump and his speed rate of change is not something we are used to in global politics and it shows.

This exhaustion manifests itself in scarce number of new interesting prediction markets as well as increasingly boring commentary on the seemingly defining events for the global order.

Well, the main reason is that with a lot of talk and change, there has been little in terms of real, actual developments regarding Ukraine, Middle East or any other crucial region for that matter. Even domestic politics is more talk than action - deportations are nowhere near the promised levels and DOGE is not only at a fraction of the promised roadmap, but also blocked by courts at every possible point.

As they say, Rome wasn’t build in one day. I had no other expectations about the changes Trump implements, if any I expected an even slower pace. So while I don’t complain, I really hope to see more action and less words and threats going forward.

Weekly Outlook

Enough of my rambling, let’s see the shape of the world.

US Inc.

We saw detailed reporting on US Inc. effort to secure peace in Ukraine, starting with US Inc. - Ukraine meeting in Saudi Arabia. I took several hours of discussions between both sides to reveal that Ukraine has agreed to a 30-day unconditional ceasefire proposed by US Inc. On top of that, US Inc. agreed to resume aid and intelligence sharing and both parties commented that the reconstruction deal will be signed soon. Hardly unconditional if you ask me.

Seems like Russia had a similar feeling, as despite Witkoff’s (Special Envoy to the Middle East) visit to Moscow and Rubio’s conversation with Lavrov, it has for now rejected the ceasefire. For me it was obvious from the start that Russia would like some trade-offs to agree to a ceasefire.

Now it remains to be seen how Trump will react to Putin’s “insubordination”. Strong pivot in rhetoric regarding Russia is not unexpected. We shall know more once the reconstruction deal is signed, which should happen sooner rather than later. Trump needs his skin in the game before he can act. For now we are waiting for Trump-Putin conversation, due to happen this week.

From other news regarding US Inc. in the recent budget cuts, it was Radio Free Europe that got dumped, angering many online, but truth be told, I doubt that radios now are consequential. Information sharing moved online and I could agree that there is no more need for it. If some of you have a different opinion and some facts to share, please do.

Lastly on deportations, Trump has tried to use the Alien Enemies Act of 1798 to deport five alleged Tren de Aragua members. Court blocked his effort for now as the act is intended to be used during times of conflict (last it was used during the WW2). Trump argues that migrants are conducting irregular warfare.

The Americas

Nothing to report, for now I’m watching closely Canada, not regarding the trade war, but assessing the new Prime Minister in the context of the upcoming election. He sure seem like a strong pivot from Justin Trudeau.

Asia

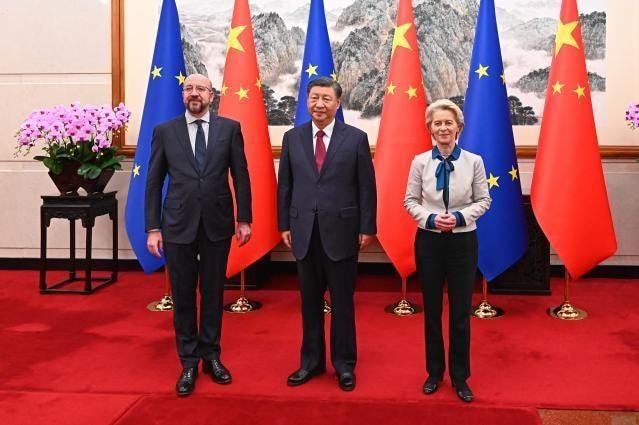

Moving to Asia, Xi has been invited by the EU to join its anniversary summit, but he declined. I’m only writing about it, because there were some voices urging Europe to pivot to China. However, when there is no plan, there is no proper execution. Another in the long series of Ls for Europe…

In the meantime, we might finally see the verdict on South Korean president Yoon impeachment. Traders (and me) are expecting the Constitutional Court to uphold the impeachment, effectively removing Yoon from office and forcing new election in two months. We shall see soon, but current odds are overwhelmingly in favor of the described:

Middle East & Africa

In the Middle East news are from all around the region. Starting with an American classic, Abdallah Maki Mosleh al-Rufayi, the "foreign operations" leader of ISIS has been killed in an air strike in Iraq. A loud, but rather small W, unless it is followed by a swift operation against the whole organization, which I don’t see happening.

Staying in the proximity, Kurds are continuing to surrender. After a truce proposal in Turkey, Syrian Democratic Forces, a Kurd militia backed by US Inc. has signed a deal with HTS to integrate it into new state institutions. Amazing what happens when funding dries up.

Moving a bit south, Israel and Lebanon will talk about their contested border under American pressure to normalize relations. With Hezbollah crippled, there is hope that Lebanon can be taken away from Iranian influence. Still a long way till Beirut can once again be the Paris of the Middle East, but I expect Team West to significantly increase pressure on Iran in the coming months.

Staying with Israel, yesterday I have seen a promo material on the Iron Beam - a direct energy weapon aka laser that can be used to neutralize missiles and drones, supposedly for a cost of $3 per interception vs ca. $50,000 for the Iron Dome. There are obvious limitations to the system (weather, time to neutralize, possibly high CAPEX), but it can be very effective against swarms of cheap drones utilized by Hamas, etc. to overwhelm the Iron Dome.

Lastly, moving even further south, US Inc. has once again started an operation against the Houthis to free the Red Sea. As I commented on X, the approach is still the same and the economics of the strategy hardly make sense. For now I expect the operation to fail, unless I see a strategic pivot. I am not alone in my prediction.

Europe

Ukrainians are being pushed out of Kursk as I write this, after Russia doubled down on defense of the region. Some are saying that it is a part of the ceasefire negotiations ie. a controlled retreat, but I strongly doubt it. In such case, any retreat would happen *after* the agreement, not before. In my opinion it is a clever strategy by Russia to take away a bargaining chip from Ukraine and push for other concessions regarding the ceasefire.

The prevalent opinion is that exit from Kursk is bullish for the ceasefire, but as I said previously, Russia won’t stop for free. Both US Inc. and Ukraine have a clear benefit from the ceasefire, while Russia having the upper hand now sees none of that. With the reconstruction deal not signed and no long-term peace plan, Russia can really push its luck as in worst case, they will just continue to fight and gain. I remain critical of the recent deal structuring of US Inc., both regarding Gaza and recent Ukraine proposals. No downside protection combined with an apparent lack of long-term planning cripples peace effort an I remain bearish on not only peace, but also any ceasefire in the short and mid-term.

In the meantime, Europe is holding meaningless summits on Ukraine that conclude with strong empty words and sadly nothing else. I won’t even waste my keyboard on describing them.

Tied to the recent developments and the prevalent fear in Europe that US Inc. may no longer be an ever-saving benevolent daddy, Poland is looking for a direct nuclear protection, be it under a nuclear-sharing program or developing its own nukes. I’d love to hear some physicist speak about nuclear weapon technology, because I get the impression that it is no 1940s and the tech is substantially easier to develop. Poland has has uranium reserves and developing a nuclear warhead shouldn’t be that difficult 80 years after the first one was made. Only issue can be other countries sanctioning Poland in such case, thus I see little chance of this happening. The only hope for Poland can be France with its recent proposal on providing a nuclear umbrella.

Business, Finance & Economics

It’s the interest rate week. Traders and bettors have little doubt that Powell will go against Trump’s wishes and maintain the current level. Even in the face of a mediocre jobs report and the stock market tanking. Many are saying that Trump is pressuring Powell to drop the rates as there is ca. $7 trillion debt to be refinanced this year and low interest rates would be highly beneficial. Well, short-term pain is expected on the markets now, not only because of this implied strategy, but also due to the uncertain global situation and ongoing trade war.

Speaking of the trade wars, now the EU is on Trump’s target. After implementing some tariffs on the union, the EU has responded with its own tariffs targeting whisky, jeans and Harley-Davidson motorcycles among others. Trump is already threatening further retaliation, while I expect that in the background negotiations are being held.

One other factor influencing the recent sell-off on the markets is Japan supposedly breaking its deflationary cycle. The infamous reverse carry trade in case Japan raises rates can put additional pressure on the markets. Is it time for Michael Gayed to shine?

Moving to business, the military-industrial complex in Europe is booming on the announcements of rearmament. The political climate is clear and the companies are looking to capitalize on both the funds and the apparent breakaway from American equipment.

Lastly, Elon Musk had a rather bad week with X undergoing massive cyberattacks. On top of that Tesla is falling faster than the market, dropping 50% from its December peak. Crisis management is busy, with Trump doing a Tesla photo-op to save his friend. Additionally, SpaceX had its rocket blow up, making a truly bad week on all fronts for the supposedly richest man in the world.

Markets

That’s all for the week. Seems like there is a lot of movement on different fronts, but mainly in the anticipation mode. I expect the action to pick up soon, especially on the Gaza front once the ceasefire situation clears out a bit and on the Ukrainian front once the reconstruction deal is signed.

Now let’s see a few markets from last week.

Keep reading with a 7-day free trial

Subscribe to PROPHET NOTES to keep reading this post and get 7 days of free access to the full post archives.