Weekly PROPHET NOTES 4/14/25

Global Outlook: tHe ArT oF ThE dEaL

This week I heard a thousand opinions based on millions of assumptions. Everyone and their mother seem to know exactly what is happening in the world. In the meantime though, the developments from the Trump administration as well as on different war theaters constantly defy majority of the mainstream predictions.

As usual though, when you hear the calls ranging from “the world is ending” to “trust the process”, the truth is in the middle. That’s the sad reality in the post-truth world.

My aim here is to be flickering light of truth in this world. Am I always right? Of course not. But I’m honest about my forecasts and you can track my results on prediction markets and monthly through my State of the PROPHET NOTES.

Follow the truth, subscribe below and see the world as it is and will be.

Weekly Outlook

Running a government is a bit like running a central bank. More important than actual policy is clear communication about it. Creating an environment of confidence in the future, whatever it may be, gives you an ability to run the affairs according to your vision.

Well, this week we’ve seen anything but it. Hank tough, because we are far from over.

US Inc.

The news of the week year are tariffs and all the turmoil around them. only this week we saw the massive US tariffs being implemented, then paused, all but Chinese ones. Then the Chinese ones were increased thrice, just to hear on Saturday that electronics, accounting for ca. 30% of imports from China, are exempted from tariffs. Polymarket traders were so excited that in their wet dream they pushed to resolve markets on Trump lowering Chinese tariffs, but considering this is exemption, the excitement was a bit premature. I don’t envy their girlfriends.

Especially since it was announced on Sunday that electronics will be hit with specific sectoral tariffs, just as auto industry. For more takes on tariffs, take a look at my recent article on the whole situation:

While the trade war is in full swing, US Inc. is also getting ready for the kinetic one. After (dubious) comments from a couple of months ago on defense budget being lowered, now Trump along with Hegseth suggest that for the next year America’s defense budget will top $1 trillion. The last one was $892 billion.

In the meantime the odds of a military clash between China and Taiwan are highest ever:

The Americas

Staying on China vs US Inc. topic, Hegseth also visited Panama Canal after the Chinese government blocked ports acquisition deal between CK Hutchison and BlackRock. Well, that was expected. Considering a wider trade war I see the Chinese doing everything they can to delay the deal. Sadly no prediction market for this event.

But it’s not all problems for Trump. At least Argentina is aligned with the new administration, managing to secure a $20 billion loan from the IMF. This comes as Milei reduced spending and inflation. Additionally Argentina is gradually resigning from currency controls, partially floating the peso, aming to attract foreign investment into the country.

Asia

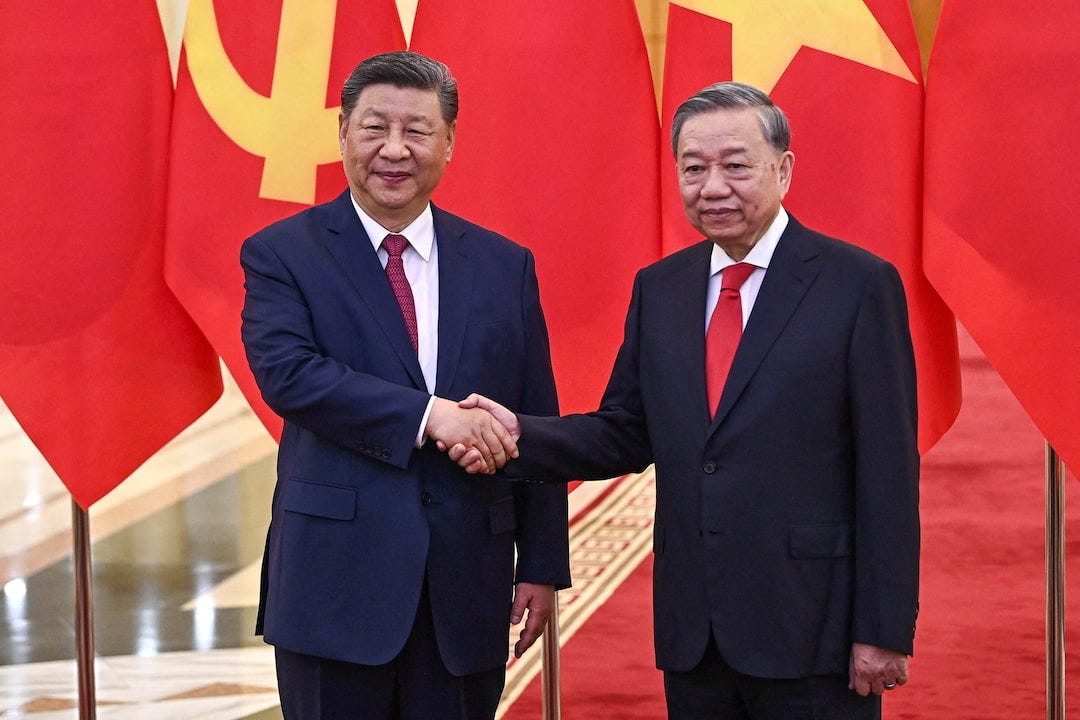

And we are back to tariffs. Despite Trump’s repeated calls for Xi to call him (I find it a bit funny that Trump behaves like a deranged girlfriend in order to portray China as bad), Xi is silent and just embarked on the South East Asian tour. He is now in Vietnam (hit by 46% tariff) and aims to visit Malaysia and Cambodia next.

As China is looking to challenge US hegemony, it won’t back down easily and in the face of the trade war it is now busy securing its own deals across the region. While it will be difficult to completely replace US demand, these moves can easily alleviate some of the pressure.

At the same time China is talking with Europe to reduce tariffs on EVs and actively fights US Inc. by imposing its own absurdly high tariffs and restricting rare earth minerals export. Fasten your seatbelts, because we are going downhill soon:

Middle East & Africa

The one region that gives us a bit of a breather from the tariff drama is the Middle East & Africa. However, only because it is engulfed in various wars…

Let’s start on a somewhat positive note. After some brief confrontation threats between US Inc. and Iran, the two countries are now talking, trying to reach a nuclear deal. Truth be told neither country is looking for a direct confrontation now - Iran was severely weakened by losing Hezbollah and Syria ad US Inc. is still busy in Ukraine, plus it’s engaged in heavy bombing of Yemen.

Amid the Chinese threat Trump is rather looking to tie things up in other regions, not starting a new war. Despite the reporting on the talks being positive, we heard no details and I expect at least a few more meeting before we learn something more, if anything. After all Iran is aligned with China and Russia and this might be a stalling tactic only to break the talks when the Chinese confrontation with Taiwan will be imminent. Prediction markets traders are also cautious on the developments:

All of this happens to the discontentment of Netanyahu, who would rather start bombing Iran with US blessing. For now though the Israeli prime minister should be busy enough in Gaza, where amid another ceasefire rumors the IDF took control of Rafah. There is no place for excitement though as the reports itself mention that there are still significant differences to bridge. The markets though remain cautiously optimistic:

Lastly on Israel, after some pressure from the US, there are now talks happening between Israel and Turkey on the matter of Iran. Seems like Netanyahu will need to accept Turkey-aligned government there.

Moving to Africa, the talks between Congo and M23, a Rwanda backed militia, have completely collapsed and now the continuation of the war seems inevitable.

Europe

Starting with the Ukraine war, we have a few developments here to unpack. The most interesting one is for sure the capturing of Chinese soldiers fighting along Russians. I have repeatedly said that the cooperation between China and Russia is way deeper than reported and now you have yet another confirmation of the strong ties between the two countries. The Team West vs Team East thesis that I’ve written about since starting this newsletter is getting more real by the day.

Moving on, Ukraine has reported that the Russians have started its spring offensive, somewhat inaugurated by striking Sumy and killing a few dozen of civilians. Ukraine is screaming war crimes while Russia says that Ukraine is using civilians as live shields. We though will never know the truth.

Among all this fighting, Witkoff has visited Russia and met with Putin to discuss the ceasefire. Also the US and Russian delegations met in Istanbul on Thursday to discuss normalization of embassy relations. Let the traders show you though how they see the chances of ceasefire (I am extremely bearish on it as well):

Europe seems to recognize the low chances as well as several countries have recently pledged in total $24 billion in additional military aid.

Now back to global trade war. Induced by the US action, Europe is now negotiating a free trade agreement with UAE. I wonder what UAE buys from Europe, but we might learn more about it soon. Seems pretty inconsequential for me.

Additionally Britain passed an emergency law that puts a steel plant in Lincolnshire under government control. Previously the plant’s Chinese owners rejected a $650 million rescue package claiming that furnaces there were financially unsustainable. Seems like Britain woke up and realized that it needs its own heavy industry. Nationalization is a probable next step.

And lastly, we finally have a coalition deal in Germany. CDU will partner with SPD to govern in an all but signed deal:

Business, Finance & Economics

If we are to believe some of the surveys and rumors online, companies are halting projects and preparing for layoffs amid uncertainty around the global trade. What can I say, as expected. You’ve already seen the recession odds, in my opinion they are way to low.

The bond market in the US tells a similar story with yields on long maturity bonds going up, defying Trump’s master plan. Some online consumed too much hopium and still believe that there is some grand strategy behind all the chaos. Let me tell you - there is not. Also overall expectations is that they will go even higher:

We may only take some comfort that there was at least a concept of a plan. Amid all the chaos, Trump administration is reviewing the potential purchase of US Steel by Japan’s Nippon Steel. Biden was the one that stopped the deal back in January and Trump is now following through as he is looking to onshore manufacturing. He’s proposal includes Nippon investing in US Steel rather than outright acquiring it.

Bonds and stocks are not the only ones experiencing major swings. Amid growing fears of recession oil prices plunged down to the lowest point in almost four years as traders fear recession. Similarly gold has risen to all time high and is bound to go higher as investors pile into safe, inflation-proof assets.

Speaking of how tariffs affect global trade, last week I mentioned that British automakers are suspending exports to the US. Several others have now followed, including Porsche and South Korean industry (eg. Hyundai) that is also expected to receive a relief package from the government, including tax cuts, subsidies and other forms of financial support.

Unrelated to all, amid the long-term luxury brands consolidation, Prada will acquire Versace for $1.4 billion. Versace was struggling in the last few years with sales dropping 15% y/y in the last quarter of 2024.

Wrap up

That’s all for the week. The chaos continues and this week we are bound to see even more moves as we are looking to learn more about sectoral electronics tariffs and pharmaceutical tariffs that are supposed to go into effect in the next 1-2 months.

You know my take on the whole situation, let’s say I hope you are liquid - opportunities will be plenty. For now stay strong and we’ll see each other soon!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.