Weekly PROPHET NOTES 8/26/24

Global Outlook: PROPHET on vacations, but the world never sleeps

My content creation rate took a bit of a hit last week - both being on vacations as well as some personal turmoils have effectively prevented me from engaging frequently on a day to day basis. Despite all of this, the world moves on and while I was quite silent, I had a little time to at least follow the global events. So let’s dive into the summary of last week and outlook for this week and I hope that with personal turmoil mostly resolved, I will be able to comment more on the daily basis on X as well.

Weekly Recap

American politics can turn any new development into big news. And with little new developments last week, we anyway had a lot of election focused news. Boiling it down to essentials, we had two main things that influenced the current odds:

the DNC and Kamala’s coronation as the official nominee,

RFK suspending his campaign and endorsing Trump

Surprisingly the first event was more favorable to Trump and the second event coincided with an odds correction towards the 50/50 we see today. But let’s tackle them on by one and understand what has happened.

Kamala’s speech was I will not be fake, I did not watch it whole. Seemed a bit pointless. The parts and snippets I watched were everything I expected. The platform is known and it takes the best part of the responsibility of odds drop. The politics of joy is catchy, but lacks substance. I guess standalone a shallow platform is good, but combined with recently announced economic policies it resonated badly. In effect we have a toss-up and for me this is exciting. Now the real race has started and I am looking forward to it.

As of RFK suspending his campaign I have got only two things to say. One is that once again we have a large dispute on Polymarket as he did not technically resign. He will stay on the ballot and campaign with Trump, but his ticket will not work any more to secure more votes. Polymarket clarification sided with the Yes voters, but once again I do not believe that this decision is a good one. He is still on the ballot and only withdrew from the battleground states, where he endorsed Trump. He is still a candidate in the election. Another cautionary tale to not bet on the markets that do not cover all scenarios in the rules.

The second thing is that his endorsement changed little for Trump in terms of odds. This was expected as his base and chances were marginal. Nevertheless, I think that in the end it will make Trump’s job easier and get him some additional edge vs a scenario in which RFK is still on the ballot in those states. Odds do not reflect this, but for me it is still a bit bullish for him.

Leaving US politics behind, we had a war focus this week, this time with the Middle East. Seems like we switch focus every week recently. Tensions increased between Hezbollah and Israel with strikes going both way. Both sides touted victory, truth as always is somewhere in the middle, but overall it seems that Israel has avoided major loses for now. Hezbollah claimed some kind of victory, but also mentioned that this was only the first phase. As expected to be honest, we will see a seemingly never-ending conflict in the region for some time, same story with ceasefire and constant adjustments by Israel and rejections by Hamas.

As the piece on the Middle East is recent and does not need any updating, I am still mulling over what to write as this week’s deep dive. Due to my vacations and limited internet access it will likely be delayed again - I will let you know on X as soon as I have something tangible so remember to follow me there and subscribe to this newsletter to get it as soon as it is published.

Focusing on the wider world, we had a little surprise a couple of days ago. Pavel Durov, founder of Telegram, was arrested in France as he was wanted for essentially lack of moderation on Telegram (for France it means aiding with all kinds of shady stuff, from drug deals to human trafficking). While majority of X is calling for his release in defense of the free speech and internet anonymity, I for now refuse to believe that he went to Paris to show his girlfriend around. Billionaires do not make such rookie mistakes when their freedom is on the line. There is something else at play.

Before we move to the global outlook, a brief on financial world. Nothing much has been happening, it is summer season after all, besides another massive jobs revision. Trust the data they said.

Global Outlook this week

I will try to be brief as we are in the last week of August and I do not expect much to happen. With vacation season in last swing we can enjoy the hot summer days and refocus on the global drama next week.

US Elections

I have already said a lot on US elections topic in the weekly recap section. I had a decent week on prediction markets with my bet on Kamal Harris being a nominee (obviously) hit. Once again thanks to sub 80 IQ accounts on X for pushing last moment Michelle Obama swap. 1% return may seem small, but if it is in 3 days, the annualized return reaches 200% on a sure thing. You will not get a better deal anywhere else. Polymarket with all its shortcomings on the resolution process is the only platform that can offer this at the moment.

As there is not much to cover in the coming week on American politics, I will stick to prediction market recap. I do not really like mentions markets, as they are a bit hit and miss ie. there is no edge for me to have. I played a bit last week with “abortion” and “joy” on Kamala’s speech and as expected hit one of the two. I do not do big volumes there and treat it like a bit of fun.

One of the markets that I believe is severely underpriced now and I am looking to deploy more capital into is the Taylor Swift endorsement market.

I punted into it at 90c believing this is already value. At 80c this is a 25% return on a trade just short of a bond. Taylor Swift is a major celebrity and pop star that has engaged in politics in the previous election cycle. She fiercely opposes Trump (remember the viral photo of her baking in Biden / Kamala 2020 shirt?) and would not miss the opportunity to endorse a potential first black female president of the USA. If you want you can try to time the market as theta may have some impact on the price, but I consider 80c a steal already.

As for other markets I try to stay away for now from major elections markets. I did get a discounted Trump Yes on winning some time ago and I am holding this for now as I have a gut feeling that he will win in the end, but I will not increase my position. I am holding a bit of cash right now, looking for some opportunities in more short-term dramas.

To have a bit of an outlook in this outlook I expect that between now and the debates both candidates should and would engage in some unscripted interviews. For Trump this is a sure thing, but for Kamala it has not happened yet. She faces some criticism for it so I am looking forward to hear her with some left wing pundit soon. One benefit for her of not doing it yet is that any interview ow will attract major audience.

Besides, I am looking to enjoy my rare vacations and get some needed sun exposure so I hope that we all can chill a bit this week.

And that’s a wrap on US Elections.

Middle East

I am somehow glad that I have already written my deep dive on the Middle East as we entered another escalatory period. My thesis still holds with the recent developments. If you have not read my analysis you missed out on some serious long-term alpha, go and read it here.

I expect Hezbollah and Iran to be slow so after a spicy weekend we are looking towards a rather silent week as the modus operandi is to stall and stretch. Also as expected the widely touted ceasefire “success” was a flop with Hamas rejecting the Israeli adjusted deal.

Compared to last week, traders rushed into September market looking to capitalize on the current efforts, but from my perspective, this is a fool’s hope. There is really nothing much to save in Gaza and for now anything other than full exit will be met with a strong no from Hamas.

This week we will see a continuation of current fearmongering, slowly diminished due to lack of subsequent action. Somewhere in the next 2-4 weeks we will once again see an escalatory move. But for now, enjoy the sun.

Ukraine-Russia war

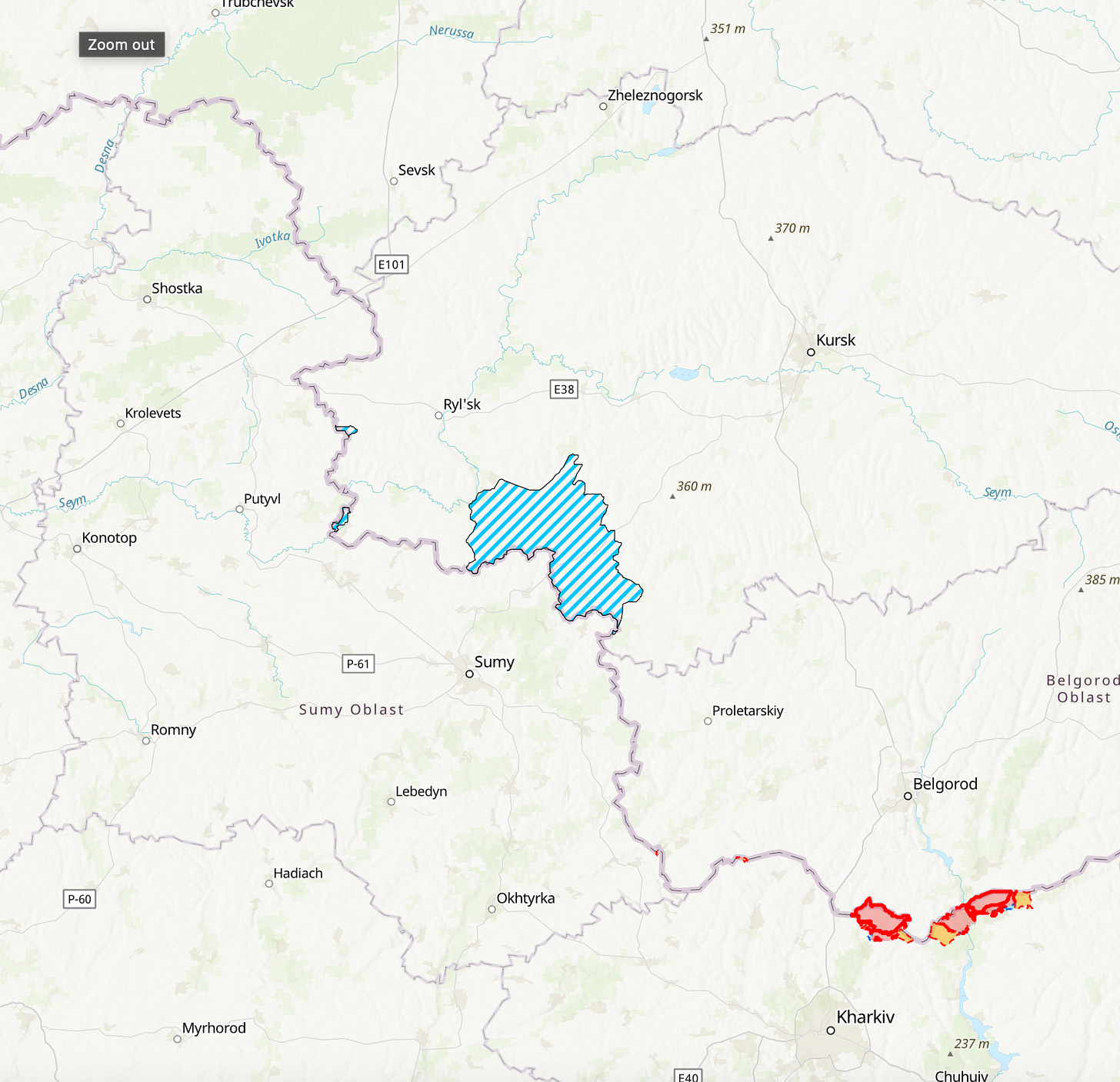

Situation in Ukraine seems quite stable for now. Ukrainians still hold their minor Kursk position, but on the other hand situation looks contained for now. If I were Putin, I would block expansion and not waste additional resources to get rid of the Ukrainian army. I still maintain my view that the incursion was hopeless and offered no strategic advantage

I will focus more on the Ukraine in the coming months, both in the deep dive I have started to write as well as in the weekly outlooks as with the clod season approaching, we will once again see more action there. The Ukrainian war was mostly out of the headlines since the last US aid package as well as the F-16s, but we already see increased Russian strikes that will further weaken Ukraine before the winter.

For now I still see some value in betting against Ukraine on holding Kursk by October 31st wit odds even better than last week. Due to theta, you can expect them to drop even further in the coming weeks, but my main thesis is that they will lack supplies to hold that long.

Europe

Europe is once again in the headlines for all the wrong reason. I touched on the arrest of Pavel Durov, but I am still thinking about the circumstances. X experts were fast to blame the girlfriend, but I do not buy it. Maybe he wanted to Tate his way to more fame, maybe there is something even deeper… I am still trying to figure out what has happened and the data is scarce. For now the Polymarket traders give him 22% chance to be released in August.

Seems like No here is value considering the coming charges, but the situation here is so bizarre that for now I will remain at the sidelines and watch new developments.

Asia

Due to lack of sufficient time, I don’t really cover Asia in depth now as there are no markets to take position on besides North Korean nuke (doubtful) and Taiwan invasion in 2024 (doubtful as well).

Let me know if you are interested in Asia to cover it in the future in more detail.

LatAm

Similarly to the above, the region isn’t really interesting from global events perspective. We have some Venezuelan mess right now, but it seems that Maduro’s grip on power is strong

As above, let me know if you would like to see LatAm coverage in more detail.

Finance

After DOJ revelations and Michael Gayed continued doom predictions the markets are relatively stable. I did not spend enough time to cover this section so you would be better off looking at finance related accounts for this week’s predictions. Anyway finance is slow during August. Priorities I guess.

Wrap up

That’s all for the coming week. I am coming back to enjoying some sun and we will see each other in this week’s deep dive - topic TBD with announcement on X. As always, your feedback on content is appreciated.

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.