Weekly PROPHET NOTES 9/2/24

Global Outlook: Back to school

And we are back to school. While all the kids began their annual cycle of school, I am back from vacations as well, rested and ready to take the best I can from the rest of the US election cycle. Let’s see what happened last week.

Weekly Recap

Trump managed to claw back the lead and as of now he has a slim 3 percentage point advantage over Kamala with 8 days till the debate. There are three main reasons for that, one being RFK Jr suspending his campaign and endorsing Trump, the other one being the dismal performance of Kamala during her first interview and the last one being Kamala lying about Arlington families.

Impact of RFK is rather small so I will skip the commentary of this. For the interview, this time I forced myself to watch it and left a quite extensive commentary on X so I will not repeat myself. You can read it here. Verdict: no blunder, but bad.

And the third is the lie that Trump somehow disrespected families of the soldiers in Arlington. This turned out to backfire badly and thus we see the 3 point lead by Trump.

Nothing really substantial in the coming week, both candidates will be rather busy preparing for the debate. Very good value in the market below.

7% return in 8 days hinging on either candidate becoming seriously ill or some natural disasters. Some deals are just too good.

Leaving US politics behind, we had an overall breather in global events. X was banned in Brazil in this continuing saga between Elon Musk and Alexandre Moraes. Bill Ackman is once again trying to IPO his fund. Put some free alpha on X about this, next time I will publish it in the paid article first, then on X. I was even on point with proper price:

You can read the post here. Still thinking about the topic of the next deep dive - I will let you know on X as soon as I have something tangible so remember to follow me there and subscribe to this newsletter to get it as soon as it is published.

Focusing on the wider world, Pavel Durov is out of jail and shopping for apartment in Paris. He seems to have achieved his goal of sightseeing Paris with his girlfriend. Some people can really get away with anything.

Global Outlook this week

Brief one this week as we are nearing the end of slow news cycle and beginning of a crazy last 2 months of the US elections campaign.

US Elections

I have already said a lot on US elections topic in the weekly recap section. I am still holding Taylor Swift endorsement market Yes as well as both debate Yes markets:

This one is great value, now and then I am buying more Yes there.

This one I bought some time ago already as it seemed severely underpriced with Yes selling for ca. 85c. Now the 4.2% in 8 days looks convincing as well.

This one though is better value. As I mentioned in the recap - severe injury, death or natural disaster will prevent the debate from happening. And no way that a chance of that if 7%. This is probably one of the best value bets that you can currently make.

As for other markets I try to stay away for now from major elections markets. I did get a discounted Trump Yes on winning some time ago and I am holding this for now as I have a gut feeling that he will win in the end, but I will not increase my position. I am still holding a bit of cash after cashing out my JD Vance No on being replaced and now I am looking for some opportunities in more short-term dramas.

This week candidates will focus on debate prep so nothing extraordinary should happen between now and next Monday.

And that’s a wrap on US Elections.

Middle East

I am somehow glad that I have already written my deep dive on the Middle East as we entered another escalatory period. My thesis still holds with the recent developments. If you have not read my analysis you missed out on some serious long-term alpha, go and read it here.

Escalation seemed to have slowed for now and the thesis remains stable.

Compared to last week, traders aligned with my opinion and pushed no ceasefire option up to 54%. There is really nothing much to save in Gaza and for now anything other than full exit will be met with a strong no from Hamas. Especially now after recent dead hostages, ceasefire will be a tough thing to align on.

As expected the fearmongerning subsided and now the discussion is mostly on dead hostages and Trump x Netanyahu deal conspiracy. Somewhere in the next 2-4 weeks we will once again see an escalatory move. But for now, enjoy the sun.

Ukraine-Russia war

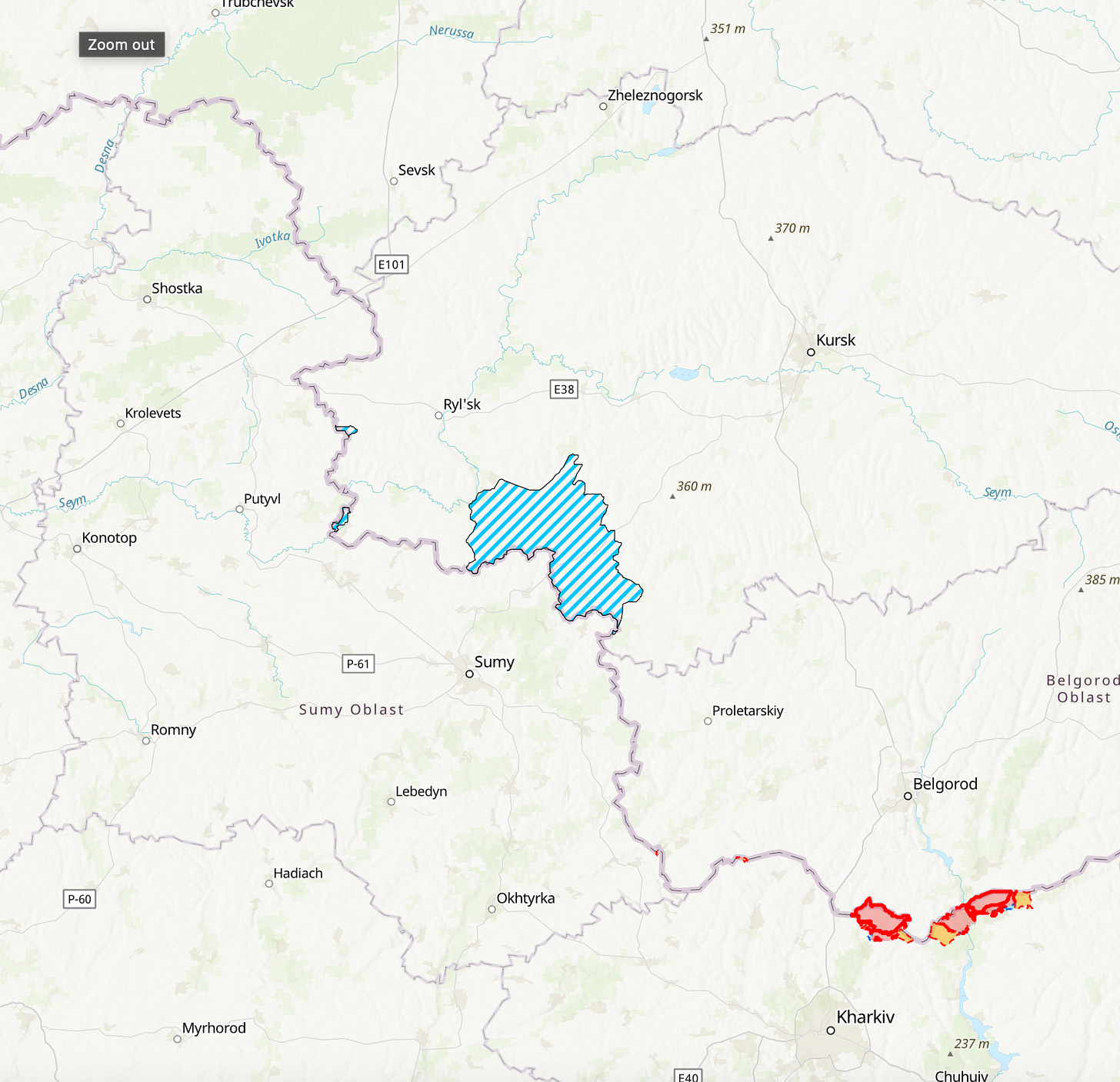

Situation in Ukraine seems quite stable for now. I did not even change the map screenshot below as nothing has changed. Ukrainians still hold their minor Kursk position, but on the other hand situation looks contained for now. If I were Putin, I would block expansion and not waste additional resources to get rid of the Ukrainian army. I still maintain my view that the incursion was hopeless and offered no strategic advantage.

I will focus more on the Ukraine in the coming months, both in the deep dive I have started to write as well as in the weekly outlooks as with the clod season approaching, we will once again see more action there. The Ukrainian war was mostly out of the headlines since the last US aid package as well as the F-16s, but we already see increased Russian strikes that will further weaken Ukraine before the winter.

We also saw the first F-16 down which came quite fast and showed a fundamental weakness - lack of replacement supply.

Europe

Nothing much on Europe this week, Pavel Durov out, other countries stable. Europeans are enjoying sun, espressos, martinis and cigarettes as every summertime.

Asia

Due to lack of sufficient time, I don’t really cover Asia in depth now as there are no markets to take position on besides North Korean nuke (doubtful) and Taiwan invasion in 2024 (doubtful as well).

Let me know if you are interested in Asia to cover it in the future in more detail.

LatAm

Similarly to the above, the region isn’t really interesting from global events perspective. We have some Venezuelan mess right now, but it seems that Maduro’s grip on power is strong

As above, let me know if you would like to see LatAm coverage in more detail.

Finance

Finance is till slow, FOMC meeting still ca. 2 weeks away and Nvidia down 8% after earnings but still 11% up in a month. Crazy. Oh one more thing. We have an interesting market on Apple investing in OpenAi in 2024.

This is my bread and butter professionally so maybe I will focus on this for the deep dive. The problem usually is that there is almost zero public info on such stuff. There are some indications though and I have a hypothesis that I need to verify. We will see, time to do some research.

I did well on previous M&A / Strategic Partnerships markets. They seem to be heavily mispriced usually as people have limited idea of how actually the process looks like and how much time it takes to align on everything. I have high hopes that I can find some alpha for this market as well. Startup funding has shorter timelines than corporate deals though so this can be interesting. Stay tuned!

Wrap up

That’s all for the coming week. I am back from vacation and I will see you again on Wednesday / Thursday for the deep dive, most probably on Apple and OpenAI market. As always, your feedback on content is appreciated.

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.