Weekly PROPHET NOTES 12/9/24

Global Outlook: Assad is out, Macron's problems and NYC assassination

I bet that Bashar al-Assad had no idea that a Trump victory will result in his downfall. Jokes aside, after years of fighting, just as the ceasefire agreement was signed between Israel and Hezbollah, the regime was toppled in a matter of a week. This was just one of the highlights of last week, that brought us quite a bit of excitement.

Were not it for Syria, the headline of the week would have come from Asia. However, more on that in just a moment. While the world was busy on the Asian continent, I went ahead of the pack and put out my analysis on how will 2025 shape up there in the context of Ukrainian war:

I was caught by surprise with the rapid fall of Syria so for Europe I am already prepared. That being said, considering the current situation in the Middle East, a closer look on the region is next on the agenda. Subscribe to have it as soon as it comes out and now let’s look at the recent developments.

Weekly Recap

The major headlines this week came from Asia, but beneath the surface, the whole globe was especially busy this week.

United States

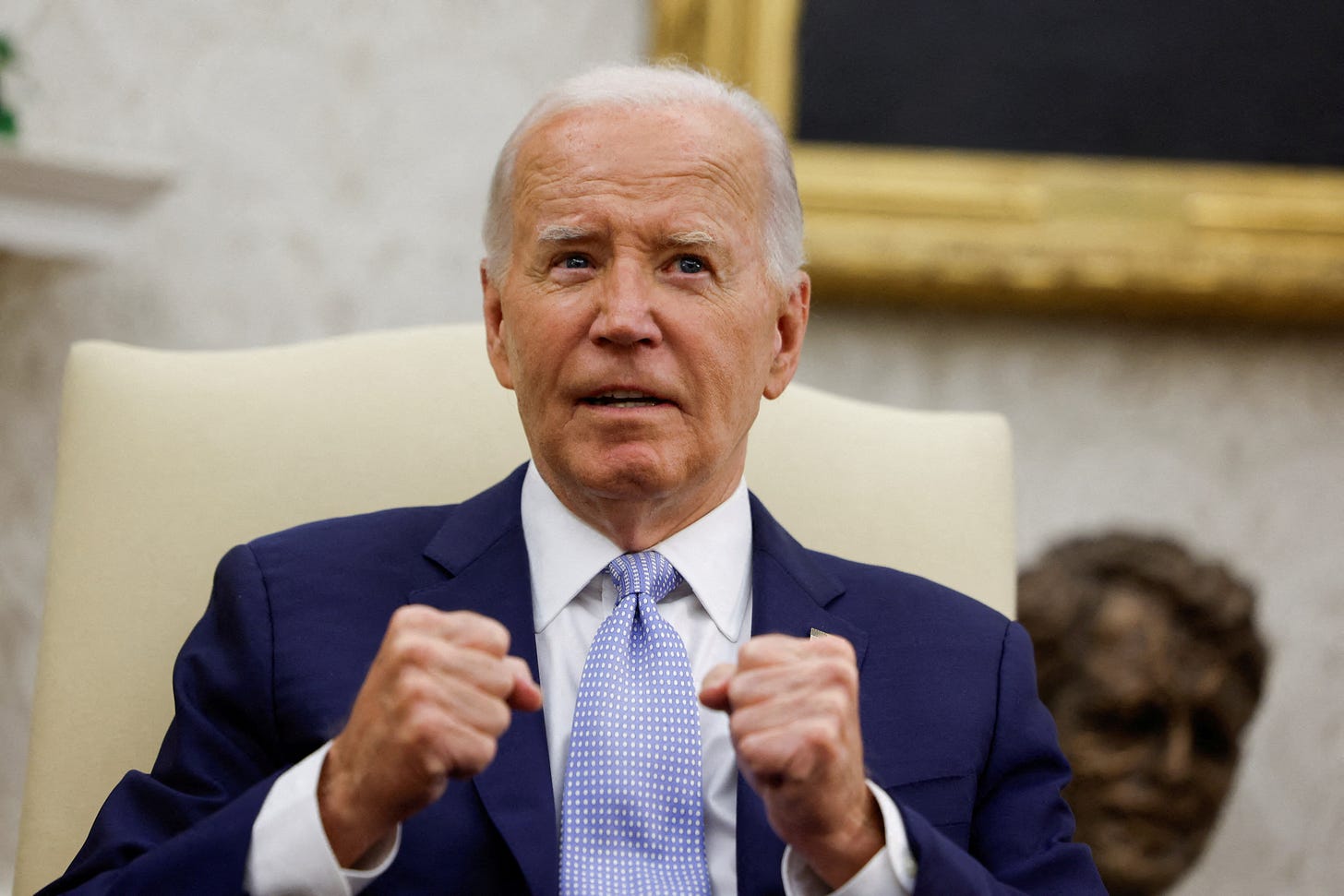

America is transitioning to Trump’s administration and Joe Biden is wasting no time - among his trips to Angola recently and a scramble to deploy all available funds to Ukraine, he has upset his supporters by pardoning his son, Hunter Biden, for every action committed in the last 10 years, effectively ending all probes into him.

While the circumstances have changed, he went against his words about nobody being above the law.

Meanwhile Trump continues with his nominations, with Kash Patel for director of FBI, Massad Boulos (Tiffany’s father-in-law) for senior advisor on the Middle East and Charles Kushner for the ambassador to France being the most controversial form the past week.

Lastly, California has counted its votes, officially marking an end to the national vote counting. Republicans hold now the presidency, the Senate (53-47) and the House (220-215), increasing expectations around Trump’s ability to deliver sweeping changes he promised.

The Americas

While the situation in the South America remains stable with Bolsonaro topic falling outside of the news cycle, Trump tariffs threat compelled Justin Trudeau to visit him in Mar-a-Lago for a discussion. With 75% of Canada’s exports going to the US, he has no choice but to cooperate. We are bound to see Canadian government becoming much more favorable to the new administration.

Asia

South Korea went into martial law for a brief six hours, after the president Yoon Suk Yeol accused the governing party of being on the North Korean payroll. It soon turned out that in fact the president’s own party is against him and he was forced to cancel the martial law declaration six hours later, effectively ending his political career.

Yoon is now looking towards another impeachment (he managed to survive the first attempt) and he was banned from leaving Korea.

Middle East & Africa

Syria has surprised us all this week - the Assad regime is gone, Bashar himself is now in Russia and we are waiting to see what will come out of this. I am still contemplating it, this or next week the deep div eon the situation should be out as I believe that it is not over in th eMiddle East and we are bound to see more action there.

From more peaceful news it appears that the opposition has won the Ghanian elections as expected.

Europe

French government has collapsed after a no confidence vote over a budget dispute. The fragile minority government was always fragile and now once again Macron is cornered with both low approval ratings and no majority in the parliament.

From other election-adjacent news, Fianna Fail has won the Irish elections as expected and will govern Ireland with Fine Gael.

On an Eastern European flank, Ukraine is busy trying to control its fate, mostly by reiterating the need to be a part of NATO. Additionally, there are violent protests in Georgia after the current government suspended accession talks with the EU.

Business, Finance & Economics

Lastly, a few business news. Paul Atkins was nominated by Trump to run SEC. Paul is supposed to be pro-crypto and the move was appreciated by the community.

From the less glamorous news, Brian Thompson, CEO of UnitedHealthcare, was assassinated in the middle of the New York City by a masked gunmen who later fled the scene. CEOs are afraid and private security detail prices in the US rose dramatically.

On the other side of the globe, the Vietnamese property developer Truong My Lan was confirmed that the death sentence stays in place, unless she will be able to return 75% of the $12 billion she embezzled from the banks. Rumors are she is fundraising like her life depends on it.

Global Outlook

Despite many headlines from last week, the week ahead does not look to be as busy - with the festive season coming I expect less drama as even politicians need to rest. However, a few things are in development and they are bound to continue regardless of the family dinners.

United States

From the current US administration you can expect to see more pardons and some last minute actions like drawing down on the remaining Ukrainian facility. With a little bit more than a month left, there is not much else to do.

Meanwhile, you can expect Trump to be more and more involved with the international affairs, as we have seen on Friday. For now I expect his comments to induce some volatility in terms of perception, but we will need to wait for the real action until 20th of January.

The Americas

The rest of the Americas is expected to remain stable.

Asia

In Asia all focus will be on South Korea. The current president has managed to survive the first impeachment vote, thanks to his party boycotting the vote. However the popular expectation is for him to go - we can expect another attempts soon.

Middle East & Africa

In the next few weeks all eyes in the Middle East will watch for any indication on the future of Syria. With Assad out, a new government must emerge and I expect USA to be actively involved in it.

It may turn out to be a great day for Syrians (or a bad one), but my eyes will be looking for the clues on the impact on Hezbollah. Syria was for a long time a trade route between Iran and Hezbollah. Iran losing control over Syria can have outsized effects on Hezbollah’s rearming ability and with that on the future of the ceasefire. More on that in the coming deep dive.

Europe

In Europe there are several things to watch for. First one is France, where Macron is expected to appoint the new prime minister within days. I do not have any types here, but I expect him to continue to try forming a centrist government up until the next possible election day which is in July 2025.

Staying with elections, in Romania we can expect news on the new presidential election, both the dates as well as information on the be or not to be for the previous first round winner Călin Georgescu as there is a possibility he will be banned from running on (probably) Russian ties accusation.

The whole Romanian situation is extremely dangerous long-term. The first round was annulled, without any definitive evidence of fake votes / ballots / hacks into election infrastructure. The mere accusation (which is probably true) of foreign interference (through funding of the campaign), because the supposed Russian candidate was too popular on TikTok is not enough. I say this with a heavy heart, but this creates a precedent to annul any election in which a “wrong” candidate won. European Union is silent on the matter, I wonder how would they react if it was a leftist candidate who got such treatment.

Lastly, after the Trump x Macron X Zelenskyy conversation we can expect more rumors on the future of the Ukrainian war. Luckily, I have already covered it, link in the intro to the article.

Business, Finance & Economics

In business, this week we are awaiting two important events. First is the CPI print in the US. Majority of the bettors expect a 2.7% print, 0.1 p.p. above the last month’s print. With the recent apparent decoupling of the market interest rate and Fed interest rate, I need to do a bit of research and form an opinion. I am overdue a proper economy piece and it looks like a perfect time.

On the other side of the pond, ECB is expected to decrease the interest rates by 25 bps. Nothing out of the ordinary, the ECB is following the Fed.

Markets ending this week

Coming to markets, there are few of them ending soon. With the end of the year in three weeks, majority of the markets are due to finish on December 31st. Nevertheless, I have a few interesting opportunities and the new market section is ripe with great deals.

Keep reading with a 7-day free trial

Subscribe to PROPHET NOTES to keep reading this post and get 7 days of free access to the full post archives.