Polymarket Trading Strategies: Noob to Turbo Autist

My best tips & tricks to earn on Polymarket

I’m a full time trader on Polymarket and up 402% on my bankroll since the start of 2025.

Some of my largest bets this year:

2.5x on the Polish presidential election upset

Multiple 2x on Trump mention markets (Betting he wouldn’t say “crypto”)

Another 2x on the German election, correctly predicting the AfD result

Several wins on Gaza ceasefire markets (1.3-2.5x returns) betting on No ceasefire

My running thesis on no ceasefire in Ukraine, printing across several ceasefire markets

If you’re used to stocks or crypto, trading on prediction markets is a different beast. Over time I’ve added several strategies to my game that create small edges.

Separately, these may not seem like much but over time, these can make a difference between being in the red and in the green.

I’ve already done a couple of articles on perception, approach and my edge.

Now it’s time for an actual Polymarket trading 101.

Subscribe below and enjoy!

Normie

Let’s start with the basics.

Know What You Are Betting On

This may sound absurd, but it isn’t. Oftentimes you see a hot market and want to just smash buy. Like me on this market recently:

One day I woke up and saw a video of a DOD spokesperson saying that the US will no longer actively mediate Russia-Ukraine peace talks. With little thought, I bet some on Yes.

And I wasn’t the only one, see that spike on the chart above?

Only later did I read the rules. And they defined “pulling out of negotiations” more rigidly than a partial exit from mediating.

After I realized the mistake, I was able to exit at a loss. But it would have been much better to take 30 seconds to read the rules and avoid the stupid mistake.

Always read the full rules before trading. You can find the rules below the chart and order book, and make sure you click “show more” to expand the full text.

Use Limit Orders

Now that you have read the rules, you want to bet on your favored outcome. That big green “buy” button is surely tempting. But even here you can up your game and skim some additional profit.

Polymarket works like a proper exchange. If you ever bought stocks or crypto on an exchange you surely know what an order book is and how it works. But if it’s your first time, then here’s a quick intro:

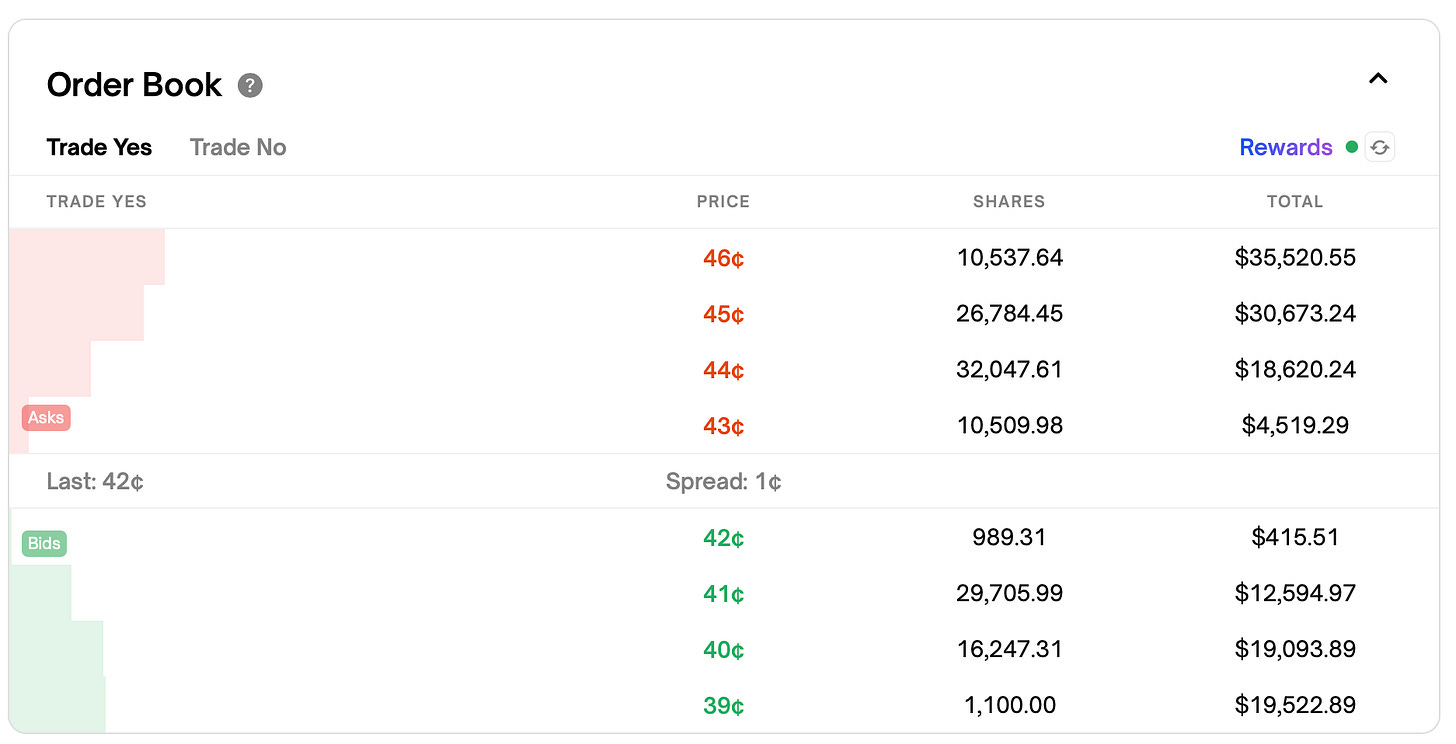

This is the order book where you view the collected Limit Orders from other traders, which are offers like:

I want to buy 1,104.01 Yes shares for 42c or

I want to sell 10,946.08 Yes shares for 43c

When you want to buy shares, you can use a Market Buy or a Limit Order. When you do a Market Buy, you agree to take someone else’s offer that is currently on the order book. When you do a Limit Order, you set your own (usually slightly better) price and wait for someone else to take your offer. That 1-2c difference in your order price can have a huge effect on your bankroll in the medium to long term.

But there is also another benefit to using Limit Orders:

Liquidity Rewards

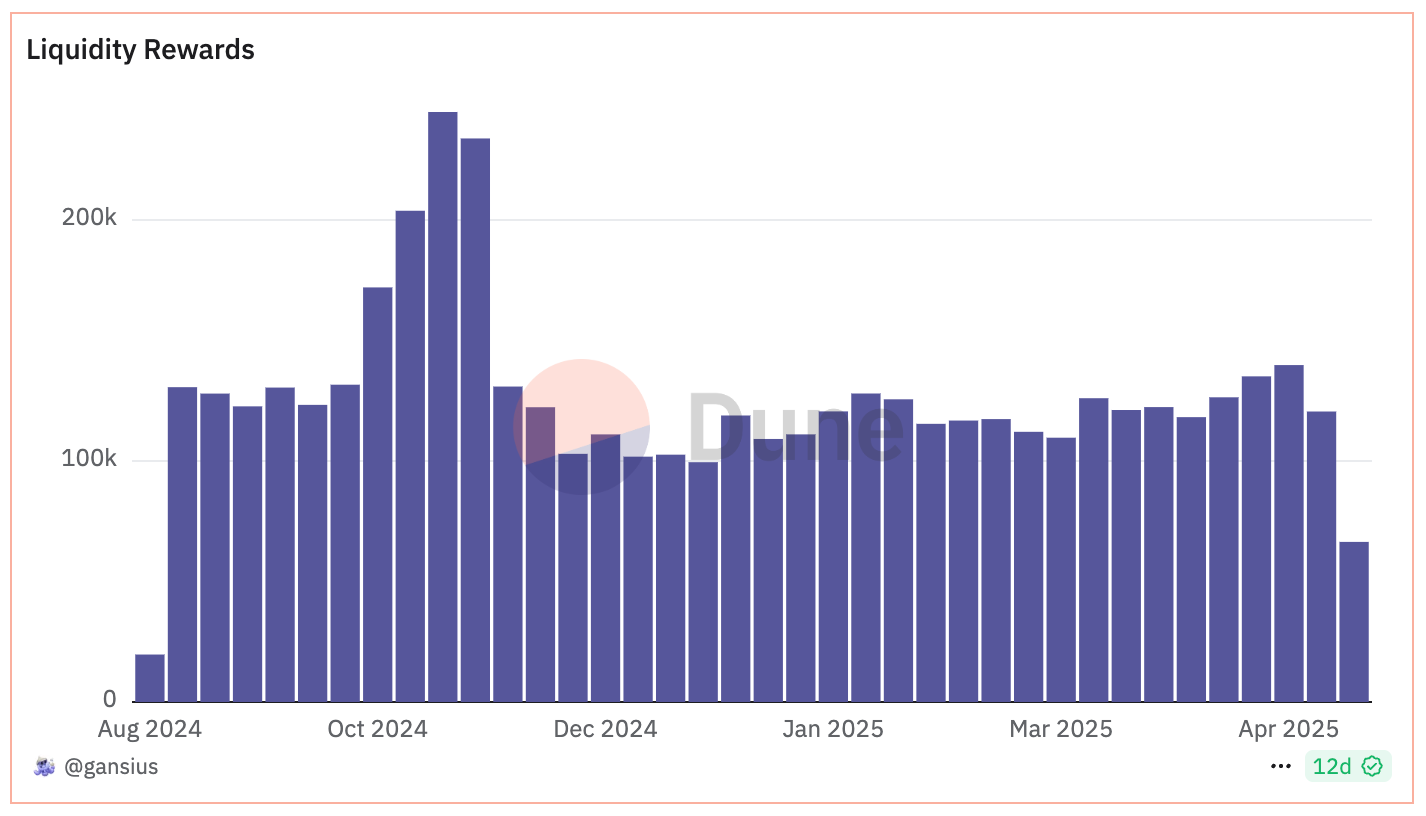

Polymarket incentivizes traders to “provide liquidity” on the platform. Polymarket pays you to have open orders in the order book that are near the midpoint of the Yes and No prices.

You can learn more about them here.

The blue circle indicates you’re earning rewards!

When you place a Limit Order close to the midpoint, your order appears on the order book and earns a share of the Liquidity Rewards provided for the market. You literally earn money for placing orders to buy or sell shares, even if they are never executed!

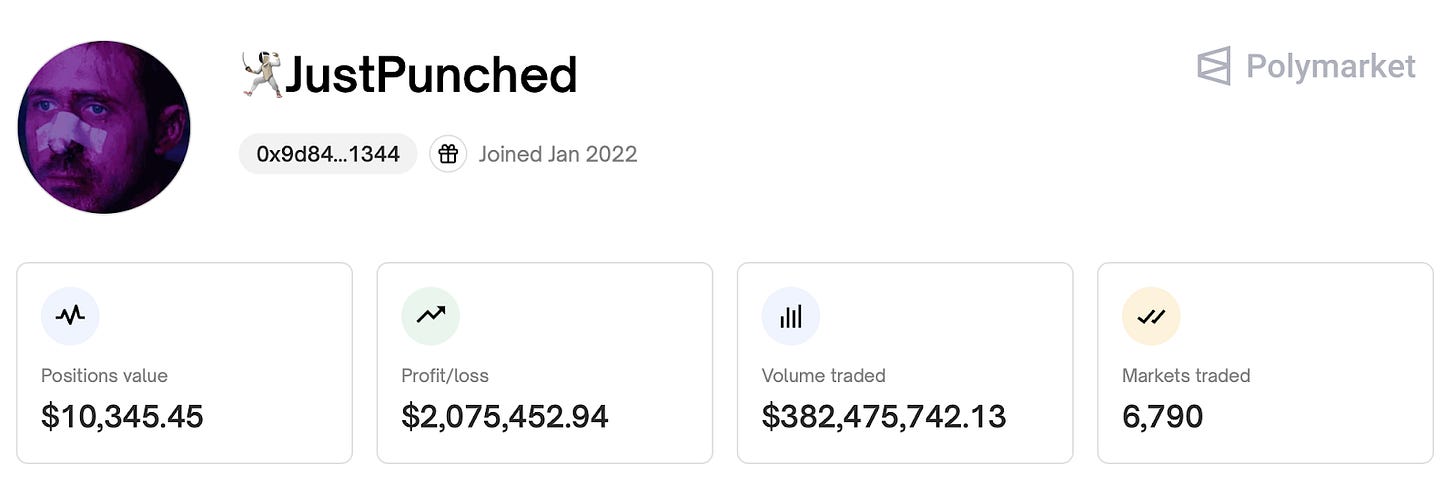

One of the biggest farmers of Liquidity Rewards is Domer, aka:

He reportedly won over $2,000,000 in Liquidity Rewards in addition to his P&L!

The rewards are paid out daily at midnight UTC. And when you are looking to be a profitable trader, every dollar counts. Especially the ones you get for free!

And it’s not small money - Polymarket pays currently around $100,000 in rewards weekly across all markets.

Autist

Now we move to the more advanced stuff.

Know Your Niche

Most people just ape into whatever parlay pays out the most and has good vibes.

But not you. You can be smarter than that.

Maybe you’re a sports nut. Or even better, you are an NBA expert. Then you have no use trading NFL markets where other experts will gladly take your money as they will have an edge. And don’t even think about touching political markets. News junkies will eat you alive.

You know best what you are good at. You don’t need to be an expert. You just need to be better than an average Joe. Use your knowledge to your advantage and see your bankroll grow.

If you are already active on Polymarket, you can use Polymarket Analytics to check your win rate by category and see what you are best at.

Here’s the breakdown for my account:

Standing Lowball Orders

Having an edge is all about taking advantage of other traders’ mistakes. From time to time there is a big trader that has a proverbial “fat finger.” This means that, instead of placing a large Limit Order, they place a Market Buy and clear out the order book. This is another reason you should always check if you are doing a Limit Order - so you are not that guy.

You can take advantage of this by maintaining some lowball orders (called stink bids) on the order book, in hope of profiting from one such mistake. After someone does a fat finger, what usually happens is that the price quickly goes back to the initial equilibrium. This means that if your lowball order gets filled, you can quickly sell near the previous market price and take profit before the market resolves (or merge shares - this is discussed below).

If you’re lucky, you can be like one trader Apsalar who made a small fortune thanks to stink bids:

The extremely low price Apsalar got shares for was thanks to the stink bets they had set up beforehand - just in case a whale got sloppy.

Here is a classic example of a fat finger transaction that allowed someone to make a huge win:

Look how they got both sides of the Kamala President by Friday market for close to 1c, making their profit close to 95c on each share in total.

By merging 5k shares on each side that they bought for a total of $95, they made $5,000 completely risk free:

Arbitrage & Hedging

I’ve written about arbitrage already, but no trading 101 is complete without it. While it is rarely seen in sports markets, you can find plenty of examples in political ones. How it works:

We sometimes have several markets that are essentially the same. One recent example I can think of is Trump tariffs markets. At one point there were two identical markets:

A solo market on Trump lowering tariffs on China

A “China” option in a group market on which countries Trump will lower tariffs

Both markets had exactly the same rules. This is an example of a pure arbitrage, where sometimes you could find 1-2c difference between how these were priced, which allowed you to make instant risk-free profit.

But you can also engage in many kinds of “soft” arbitrage. For example, where there are several markets on a given event with slightly different resolution criteria, you can take different positions (eg. Yes on one market and No on the other). Such examples can be found in election markets, especially during the US presidential election.

There are plenty of such correlated markets, if you can find them, there is a high chance you can “soft arbitrage” them for a near certain profit.

Soft arbitrage can also be used as hedging when you limit your downside with a contrarian bet on the second market. But more interesting from my perspective is timeline hedging. It’s not exactly risk-free, but it often can be profitable. For example, currently there are several markets on Gaza ceasefire with different timeframes (end of May, end of June, and end of year).

If you believe that a ceasefire will happen eventually this year, but you don’t expect it to happen soon, you can take No a positions on the short-term market and a Yes position on the long-term market. Take for example this trader:

As you see, he holds contrarian positions on different timelines on the Gaza ceasefire. He’s essentially betting on a ceasefire coming soon, but not imminently. If he’s right, he will profit from both. But if he’s wrong, one of these markets will pay out for him anyway, limiting his downside (and partly his upside in the 3rd case):

Thesis right: $810 profit + $8,700 profit = $9,610 profit from both markets

No ceasefire at all: $810 profit - $6,200 loss = -$5,390 loss vs $6,200 loss with no hedging

Imminent ceasefire: -$6,190 loss + $8,700 profit = $2,510 profit

I rarely do arbitrage as I don’t have a big enough bankroll to make it worthwhile, but sometimes I do timeline hedging.

Negative Risk

On Polymarket, look for this in the top left corner of the market.

Some markets, like presidential nominee, election winner, etc. have several sub-markets, but eventually only one of them can resolve Yes. In these cases, all the Yes prices in a given moment should sum up to 100c. Otherwise, if the sum is higher, some (or all) of the markets are overvalued and if the sum is lower, some (or all) of the markets are undervalued.

While in the latter scenario you can take advantage of the situation by simply buying undervalued shares and waiting for the market to adjust, in the former scenario, you can use the Polymarket function called “negative risk” to profit from mispricing.

The functionality is pretty straightforward: if you buy No shares for two or more options, you are guaranteed to win at least one. As only one option can be the winner in the end, if you have more No shares, they are guaranteed to pay out.

When you use the functionality, your No shares are then converted to:

Guaranteed winnings as you must be right in some cases and

Yes shares for all the options you didn’t buy No shares in.

More info on negative risk is here.

Once you convert your shares, you not only get some of your winnings instantly, but also now have multiple Yes shares that you can try to sell for overall profit (remember that the market is generally overvalued, meaning that the sum of Yes share prices is over 100c).

You can repeat these actions many times over. This way you act as a sort of “market balancer” and profit from it.

The execution of this strategy can be difficult, there are many other traders and bots competing with you to balance the markets. But more often than not you can extract value and accumulate profits over time.

Turbo Autist

But there are even more complex approaches that you can use to get the better of other traders.

Know Your Odds

Now you know to spend two minutes checking out the market rules, setting limit orders and sticking to what you know best. You know how to arbitrage and set stink bids. You’re probably already better than the majority of the normies – but you can go even further.

Sometimes you see the market and you are not happy with the prices you are offered. You are not exactly sure what price would be good for you. Maybe it’s an NBA match. Or another market on the Gaza ceasefire.

You want to bet your hard-earned money, but you want to be sure the odds are in your favor. What you should do then is do your research. See the team stats, maybe some player is injured or the team changed something and is on a winning streak.

You may also want to check what odds bookies offer - both soft bookies (your usual DraftKings) and sharp bookies (Pinnacle is a great example). Check what analysts think and develop your own thesis. Try to handicap your own odds of the situation.

You don’t have to be extremely precise. Often, especially in more political markets, it’s impossible to nail down exact odds as there is little precedent. I like to aim for +/- 5% precision.

When you arrive at different odds than the market is offering, you want to take the position that is cheaper than your fair odds. Imagine there is a Celtics vs Warriors game and you developed 25/75 odds. Yet the market is currently at 37/63.

Then you should go with your analysis and bet on the Warriors to win. Not only will it agree with your analysis, but also you have an indication that you get a good value. If your odds are more correct than the market, you will be profitable in the long term, as you will scalp close to 12% in Expected Value:

if you are right, Warriors win 75 out of a 100 matches,

yet you can buy Warriors for 63c.

Then over 100 games, if you bet $100 each time, your expected profit is (warning, math ahead):

75 * 100 / 63 * 100 + 25 * 0 - 100 * 100

11,904.76 + 0 - 10,000 = 1,904.76

You see, you will earn $1,904.76 over 100 games, simply because you were better at approximating odds than the market.

The same situation can play out the other way, it can turn out that the expected loser is undervalued. Imagine that for the same game the market prices are 15/85. Then, despite the Celtics having only 25% odds of winning, you should buy them! Because if the market gives them only 15%, over 100 games you will be more profitable betting on the loser as they will win 25 games for the price of 15. Same math as above. Do it yourself and practice.

Handicapping your own odds is not that easy. Every market is different, every situation has its nuances. But with time, you will get better and better at approximating odds. And once you do, you will see more and more steady growth in your bankroll.

This is what I mostly do. From the Polish election, to Ukraine, Gaza ceasefire, and other markets like interest rates or M&A transactions. Developing these theses takes up a lot of time, but you can read here on how I approach it, take it from the Ukraine example where I already made over 2X:

There I developed my odds of a ceasefire by April 20 to be 20/80 vs the market giving it then 44/56:

I bet No as I was given great odds in my favor - 56% vs my estimate of 80%.

And I was right in the end!

Further Reading

If you want to further explore the topic of expected value and odds approximation, there are a couple of books that you should start with. First one is Superforecasting by Tetlock. A great read on how some normal people, thanks to their approach, are far better at predicting events than even CIA analysts with classified intel!

The other is On the Edge by Nate Silver, which explores how different spheres of finance and gambling find and exploit edges in all kinds of games. A great and entertaining read as well!

Am I An Autist Or A Turbo Autist

Well, both to be honest. While my prevailing strategy is developing theses and doing deep research on them (turbo autist stuff), I use arbitrage, lowball orders and I almost always put limit orders and try to farm some liquidity rewards. The only time I market buy is when I know the market can move quickly and I want the exposure.

And of course, I only move in my niche which is geopolitics, politics and economics. I never do sports markets as I know that I don’t have any edge in them. I focus on what I know and for the time being I’m very happy with my results: you can read about them in my State of the PROPHET NOTES series where I do a monthly recap of my trading and P&L - I’m up 402% this year alone and rising:

To win over time you need to use most of the strategies and tricks above. But also, you need to discover your style. Are you more of a trader trying to exploit market inefficiencies, use momentum to your advantage and do a lot of buying and selling, rarely waiting for a resolution? Or are you more of a fundamental bettor, developing theses and building positions to wait for the resolution and take max profit?

Both are fine and there are many successful traders with different styles. Some of them made millions on Polymarket!

Try, experiment and refine your approach and pretty soon you might find out that you are well in the green.

If you fancy politics, you can access my research, published weekly, just subscribe below:

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.

Great stuff! I already applied many of those, however imperfectly, but you've discovered me a few new ones.

I've got a question: how do you access your Polymarket Analytics by category? I've been browsing and can see my PnL and current positions, but can't get at what your screenshot shows.

Thanks and happy forecasting!